The COVID-19 pandemic has brought radical shifts in content consumption, enabling the M&E industry to witness a significant performance. The lockdown that followed was like the wind beneath the wings of the Indian animation industry, despite its own shortcomings.

Soaring high

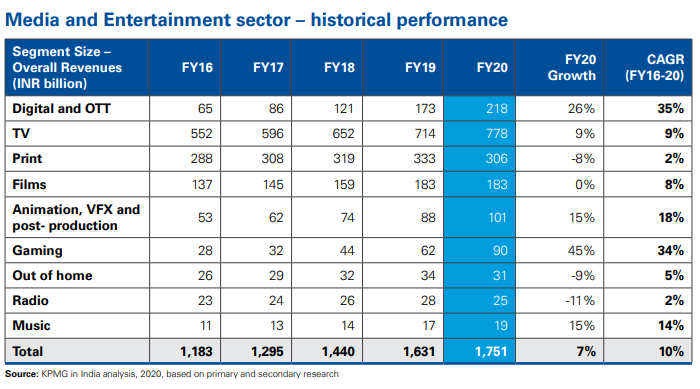

According to KPMG India’s Media and Entertainment Report 2020 – A Year off Script: Time for Resilience, that was released yesterday, 30 September, the Animation, VFX and post-production segment grew by 15 per cent from 88 bn in FY19 to 101 bn in FY20. The sector has grown at a CAGR of 18 per cent from FY16 to FY20.

- The report further states that with the significant rise in kids content consumption both on TV and OTTs, most producers have focused on creating new IPs, new episodes of popular/flagship properties as well as carrying out commissioned works in the domestic and international markets.

- The KPMG report states that the Animation industry has a registered growth of 13 per cent in FY20 with a revenue of Rs 21.8 billion. While service/commissioned work continues to have a lion’s share, IP production is catching up steadily at a CAGR of 12 per cent during FY15-FY20.

- The OTT explosion has in a way paved the way for economic smaller budget projects, experimental IPs to see the light of the day and reach out to a wider audience. The phenomenal success of Green Gold Animation’s Mighty Little Bheem on Netflix has enabled global streaming services to look at Indian animated content a little more seriously.

- Homegrown animated content are now ruling the charts on TV and streaming services (re-watching and binge watching) with almost 40 to 50 per cent of on-air content with local characters, storyline and flavours.

- Most animation studios across the globe and India have witnessed higher productivity working from home after the initial discomfort of adjustability. Pioneers like Disney, Pixar, DreamWorks and Green Gold Animation, Graffiti Multimedia, Reliance Animation too have adeptly adjusted to the remote working model and are delivering projects and launching new IPs.

All’s not rosy

- The changes in YouTube advertising policies around kids’ content during FY20 has had an adverse impact on animated IP production. Kids content is perhaps the most-watched video category on YouTube overall, suggested a survey in December 2019. Hence, YouTube’s amendments around children’s content came as a blow to kids content creators across the world.

YouTube rolled out the new rules across the globe by disabling personalised ads, comments, notification, live chat and other features on “made for kids” videos. After the implementation of the policy, content creators were mandated to mark any video on their channel as made for kids based on a few criteria which has impacted the ad revenues

- Due to the pandemic, many studios faced disruption in operations owing to the change in work infrastructure, and small animation studios were temporarily shut down. The report predicts leaner cost structures to be emerging in Animation and VFX studios.

- Lack of required workstations, proper set up, stable internet connectivity and more for many animators and artists have made ‘work from home’ a thing for the privileged.

Speaking about the major boost animation as a medium has received during the past six-seven months, KPMG Media and Entertainment partner and head Girish Menon told Animation Xpress, “With streaming giants like Netflix heavily investing in animation in general and the huge success of Mighty Little Bheem there is growing interest around animated content being put out on platforms. This effectively means that there is a greater demand for such animated content as kids content consumption, interestingly, has been very consistent before and after COVID.”