Nazara Technologies has announced its audited standalone and consolidated results for the year ended 31 March 2021.

As of 31 March 2021, Nazara has diverse business segments with revenue generation happening across gamified learning, esports, freemium, real money gaming and telco subscription.

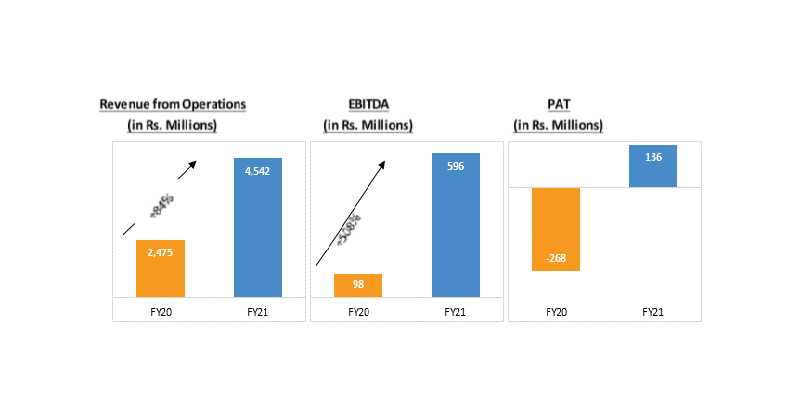

Key Consolidated Financial Highlights for the financial year 2021 are as follows:

- Operating revenue grew by 84 per cent YoY to Rs. 4,542 Million

- EBITDA grew by 508per cent YoY to Rs. 596 Million

- EBITDA margins improved from 3.7 per cent in FY20 to 12.7 per cent in FY21

- Delivered a PAT of Rs. 136 Million in FY21

- Recorded a positive net cash flow from operations of Rs. 674 Million in FY21

- Consolidated Cash and Cash Equivalents including liquid investments stood at Rs. 4,784 Million as of 31 March 2021 as compared to Rs. 2,234 Million as of 31 March 2020.

- Consolidated net worth as of 31 March 2021 grew by 37 per cent to Rs. 7,790 million as compared to Rs. 5,700 million as of 31 March 2020.

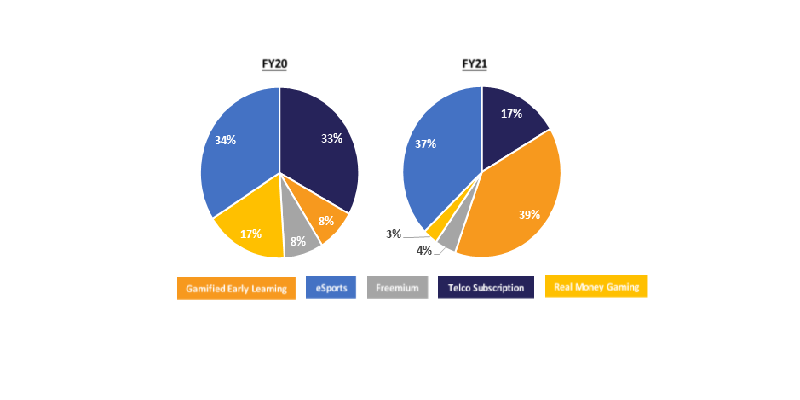

The Consolidated Revenue Mix across business segments stood as follows:

The high growth segments of Gamified Early Learnings and esports have grown by 819 per cent YoY and 102 per cent YoY to Rs. 1,758 Million and Rs. 1,701 Million, respectively.

Commenting on the performance, Group CEO Manish Agarwal said, “For FY21, we clocked a total operating revenue growth of 84 per cent on YoY bases and profits of Rs.136 Mn. As we operate in the high growth business segments of Gamified early learning, eSports and Freemium, we will continue to prioritize growth over profit maximization, so that we can achieve and maintain market leadership in segments we operate in. Prudent financial management is in our DNA. This is clearly evident from Rs. 4,784 Million of cash reserves including liquid investments as well as zero debt on our balance sheet. We will efficiently utilize our cash balance to fund any inorganic growth opportunities- from building capabilities to geographic and demographic expansions in our domain of operation. To conclude, we are in a good position to continue executing our strategy and maintain our market leadership position in the years to come.”