The fantasy sports format has already seen significant adoption by sports fans in the global market and India has also witnessed exponential growth in the Fantasy Sports user base during the last two to three years. According to the Gameplan 2020 report Fantasy Sports user-base grew from 2 million in 2016 to 90 million in 2019. Just when the time for fantasy sports was right, the first quarter of 2020 witnessed the unforeseen impact of a global pandemic in the form of Covid-19. The novel coronavirus impacted the entire globe, postponement, and cancellation of major sporting events across the globe and especially marquee properties like the Indian Premier League (IPL) back home.

This resulted a direct and adverse impact on the businesses operating in the online fantasy sports ecosystem such as online fantasy sports operators, marketing agencies, analytics platforms and others. In the absence of real-time sports, the active users on these platforms declined sharply.

It is true that, before the pandemic, the emergence and growth in popularity of sports leagues in India, coupled with the rapid improvement in digital infrastructure and payments has led to the rise of fantasy sports. This has become in no time as an alternative means for the sports enthusiast to connect with their favourite sports, and test their skills and knowledge of the game. However, the pandemic led the online fantasy sports platforms directly affected by the temporary discontinuation of sporting leagues, as these skill-based gaming platforms run on a format that has direct dependence on the real-time sport being played.

Impact of lockdown in fantasy sports

The lock-down in India was initiated just when the entire country was gearing up for Season 13 of IPL, and the online fantasy sports operators were focusing on their strategies and investments to gear up for the season. This force majeure has created business disruptions in the short-term. Industry interactions indicated that IPL, being the most popular sporting league in India, generates ~30 to 40 per cent of the revenues for most of the online fantasy sports operators. The postponing of the event has put cash-flow pressures on the operators. The short-term revenue and customer engagement disruptions have prompted the online fantasy sports operators to innovate around their offerings to generate cash, in order to reduce the high dependency on Cricket and major leagues like the IPL.

Industry interactions indicated that the operators have been proactive in their actions to combat the challenges posted by the Covid-19 crisis.

How fantasy sports platforms tackled the crisis?

Some of the FIFS members have modified their offerings while operating under the ‘game of skill’ umbrella.

While the major sports leagues across the globe were disrupted, the leading online fantasy sports operators have moved ahead to include leagues from secondary markets, which were relatively less affected by the ongoing pandemic. Here are the things that the industry find fair to do during Covid-19 pandemic:

- A long-tail of new leagues which are approved by their respective governing bodies such as Belarus Premier League (Football), Taipei T10 League (Cricket), Vanuatu T10 League (Cricket); as well as leagues in Baseball and Handball have been added by the online fantasy sports operators as a part of their offerings. While these offerings are relatively new to the Indian audience, industry interactions indicate that there has been some uptake seen in terms of engagement with these leagues, albeit not at the scale of Indian leagues.

- Streaming sporting action on associated sports content platformsDream11 along with FanCode actively worked towards bringing global sporting action which was on during the pandemic, to the Indian The platform introduced Baseball and Handball and hosted online fantasy sports matches, showcased specialised content from long-tail sports tournaments, like Vincy Premier League, Nicaragua League and many more (FanCode). Since March 2020, FanCode has live-streamed over 150 matches across 10+ leagues.

- MyTeam11 has acquired exclusive Global Streaming rights for Taipei T10 league and non-exclusive streaming rights of Vanuatu T10 League under its SportsTiger platform. The platform has been investing heavily in generating content. An interview series called “Off the field” has been started by the platform, wherein sports stars are interviewed.

- Most players have used the lean period to innovate their platform offerings to add features that would make the user experience more seamless. Dream11 focused on developing a sports social network on the platform and used the time to revisit the non-user focussed features that were no longer needed to reduce redundancies. In the coming few weeks, players like Faboom are looking to introduce new features such as ‘Responsible Gaming’ which would provide its users features such as ‘self-determined’ exclusion tenures, option to set deposit limit (daily and weekly) and contest participation limit.

- An innovative move by the operators has been their foray into quizzing. Quizzing has always been a game of skill transcending ages and social groups. These quiz-based games operate on the same participation and platform fee format as the online fantasy sports; each quizzing cohort has 4-5 users and the quiz-topics are spread across The user who correctly answers the maximum questions wins the pool. It is worth noting that the introduction of quizzing expands the addressable market beyond fans of a specific sport. This in turn helps address one of the pre Covid-19 challenges of the industry, which was to increase the participation of female users on the platform. Some operators are thus looking at integrating quizzing as an integral part of the platform in the long run.

Through these initiatives the platforms have helped recover some of the user- engagement that had seen a sharp dip amidst the pandemic and provided sports-based content for the fans who were devoid of any engagement opportunity with sports at large, be it watching or participating in online Fantasy Sports.

Going Forward

The online fantasy sports firms are optimistic that this is just a small blip in the industry’s growth trajectory. Once the overseas and domestic leagues start commencing, industry players expect a ~20 to 25 per cent jump in the revenues of Q3 FY21 over the planned revenue. The stakeholders are also of the opinion that once things return towards normalcy, a sharp recovery is expected with the leagues restarting. Companies like Dream11 have factored this into their hiring strategies with plans to add ~250 members in the near term to its existing team, MyTeam11 has also added 20 new members to it company during the lockdown and is looking forward to going ahead with hiring plans as it expands.

Platforms like FanCode and SportsTiger are also likely to broaden their array of offerings to increase engagement and improve customer experience by educating them about sports that would in turn compliment their sister platform’s online fantasy sports offerings.

Platforms like FanCode and SportsTiger are also likely to broaden their array of offerings to increase engagement and improve customer experience by educating them about sports that would in turn compliment their sister platform’s online fantasy sports offerings.

The norms of social distancing have called for revisiting the reliance on call-centres for customer support making a systematic push towards automation using chatbots and IVR. This would also benefit users through more real- time assistance, while reducing costs for the online fantasy sports operators.

Most operators have indicated that the next ~6 to 8 months post the lock-down would be focused on targeted marketing to regain users who might have migrated to other real-money game platforms or other forms of entertainment.

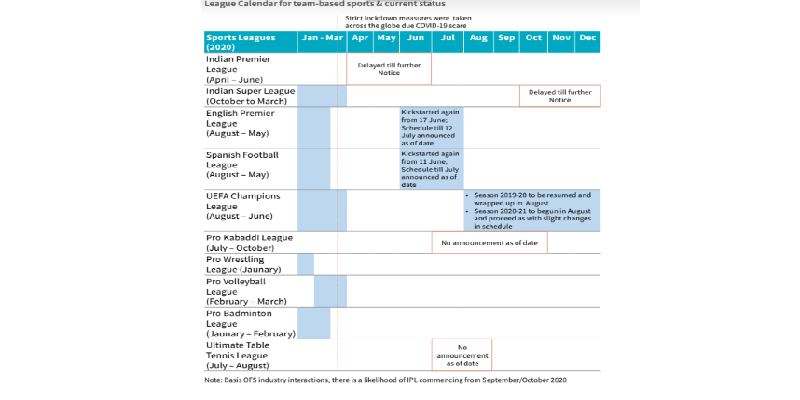

As India strives to overcome this crisis, it would be premature to comment on when the domestic sports leagues will resume. Though the overseas leagues including the widely popular English Premier League will help user engagement on the online fantasy sports platforms; IPL drives ~35 to 40 per cent of the online fantasy sports market’s revenues. If IPL indeed takes place around October – November 2020, the Indian sports fans are likely to have access to sporting leaguesand tournaments non-stop for eight to nine months spanning between October 2020 and May to June 2021. This would help partially offset some revenue loss due to the postponement and cancellation of sporting events in Q1 of 2020.