The spread of the COVID-19 pandemic and the ensuing lockdown imposed to contain the spread of the virus has accelerated the adoption of digital services among a wider base of users in the country. The Indian economy was decelerating even before the outbreak of COVID-19. The process of the gradual reopening of the economy has begun, but businesses have not been able to reach full capacities due to internal supply chain disruptions, labour shortage and weak demand. India’s GDP growth rate could show signs of improvement in H2 CY20, but the headwinds posed by the above factors cannot be underestimated. However, in between the the chaos, digital and gaming segments continued to grow at a rapid pace and positively contributed to the performance of the media and entertainment (M&E) sector.

Today KPMG launched the twelfth edition of its M&E report, titled ‘A year off script: Time for resilience’, that examines the performance of the Indian M&E sector during a particularly challenging period. According to the report, the online gaming segment in India continued to be driven by a rapid growth in mobile gaming users and an acceleration of the same on account of COVID-19, and a deeper integration of payment options which partly helped the subscription part of monetisation. While casual games continued to attract majority of the online gamers, mid-core to hard-core games with multi-player setups witnessed a surge in uptake in FY20.

Online Fantasy Sports (OFS) also witnessed strong growth during the year on the back of marquee cricket events such as IPL, ICC World cup. While card games including rummy and poker remained popular in non- fantasy real money gaming, there has been significant traction in the adoption of other non-fantasy real money casual games including cricket, live trivia and quizzing apps. Increased adoption of multi-gaming platforms made it convenient for users to access a wide range of games on a single platform. The rise of professional gamers in India also provided a huge boost to the esports segment.

Here are the key findings:

- Gaming fared much better, with massive spikes in digital consumption during the lockdown across geographies and socio-economic classes.

- A more optimistic scenario for the M&E sector is that consumers simply rebalance rather than reduce expenditure away from outdoor options such as the theatres, concerts and plays to indoor ones like OTT and gaming.

- The experience of COVID-19 will unquestionably exacerbate these trends, and the M&E sector is expected to contract by 20 per cent over the coming year, with digital and gaming projected to be the only segments to grow.

- In months, online retail, food delivery, digital payments, virtual healthcare, virtual learning, online entertainment, and gaming have seen consumer adoption rates that were expected years Cloud technology providers, data centre players, video conferencing platforms, digital lending start-ups, and workplace automation companies have thrived as businesses have accelerated digital adoption to keep up during lockdowns.

- For near term gaming witnessed a spurt in consumption (except fantasy sports), and partly subscription led Gaming value chain relatively less disrupted, with companies transitioning to work from home. However in long term the sector will increase in monetisation through in-app purchases could play out over the long run and the evolution of gaming as a means of virtual social interaction.

- The M&E sector is expected to bounce back in FY22 with a growth of 33.1 per cent over FY21 to reach a size of INR1.86 trillion, at a CAGR of 3.2 per cent over FY20-22,7 with gaming and digital being the fastest growing segments.

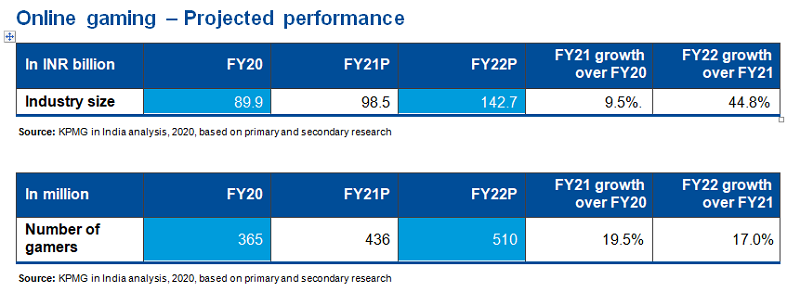

- Between year 2016 and 2020 gaming sector has witnessed growth in revenue at 34 per cent CAGR from Rs 28 billion to Rs 90 billion.

- Gaming was the fastest growing segment with a rapid increase in consumption translating partially into monetisation, although from a lower revenue base.

- The online gaming segment registered an impressive 45 per cent growth in revenues in FY20 with the user base surpassing 365 million by March 2020, with Real Money Games (RMG) – both card -based and fantasy seeing strong traction. Casual gaming also saw strong consumption uptake in FY20 with in-app monetisation also starting to see momentum.

- Animation studios likely to focus on own IP for segments like Gaming, Edtech and more.

- Between year 2020 and 2022 gaming sector will witness growth in revenue at 45 per cent CAGR from Rs 90 Billion to Rs 143 billion.

- Digital and gaming are projected to continue their strong growth in FY22 as well, with the habit formation around consumption translating into greater monetisation.

- Nearly 95 per cent of the respondents anticipated a much greater focus on digital initiatives in their organisation in the near future, with the rest already being present in a digital first environment.

- Nearly 70 per cent of the respondents felt that the greatest benefit of technology could be felt in the content creation and post-production functions in their respective organisations.

- The rapid growth of gaming has meant that ‘Direct to Consumer’ platforms across the digital value chain are starting to look at gaming as a critical use case which would drive greater consumption, optimise customer acquisition costs (CAC) and help user retention in the long term.

- Apart from user acquisition and retention, cross product monetisation on the platform, a better understanding of consumer behavior, targeted advertising and rich data for customer analytics are some of the benefits that gaming as a use-case provides digital platforms.

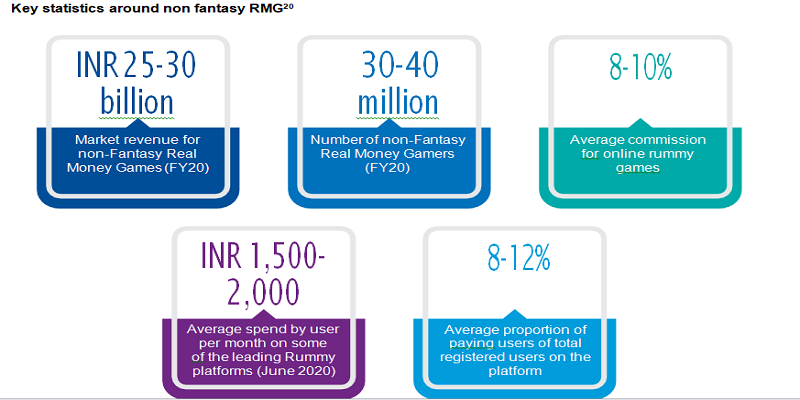

- The market size of Non-fantasy Real Money Games is Rs 25 billion to Rs 30 billion, casual games is Rs 36 billion to Rs 39 billion and online fantasy sports is from Rs 23 billion to Rs 27 billion in FY20

- From 2018 to 2020 the number of online gamers have increased to 16.5 per cent.

- As of July 2020, the total online gamers have crossed nearly 400 million in India. As India is a mobile-first country, more than 90 per cent of the online gamers in India play mobile games.

- Casual games are most popular genre in India as a majority tend to play casual games, owing to their ‘Free to Play’ nature. India is among top five mobile gaming markets by user base in the world. In 2019, around 5.6 bn mobile gaming apps were downloaded in India – the highest in the world and representing nearly 13 per cent of gaming apps in the world.

- Casual games such as Ludo King and non-fantasy sports real money casual games including card games, live trivia and quizzes witnessed the strong uptake during the lockdown as they attracted new users who were discovering newer gaming options. While OFS witnessed strong growth on the back of IPL in FY19, postponement of IPL and decline in live sporting events negatively impacted the platforms in the first quarter of FY20.

- Online games like Ludo King, World Cricket Championship (WCC), have witnessed an uptick in monetisation across all streams of revenue.4 Monetisation by advertisements and in-app purchase varies across genres of casual games. While arcade and word-based games earn 80 to 85 per cent of overall revenue from advertisements, actions games like PlayerUnknown’s Battleground (PUBG) earn nearly 60 to65 per cent of revenue from in-app purchases. While advertisements continued to have a higher contribution in revenue, particularly for the casual gaming category, there were green shoots indicative of increase in consumer spends on online gaming.

Some of the Ad formats that are gaining traction include:

- Playable ads allow a user to play a demo version of the game which is followed by a call to action for downloading the game.

- Rewarded videos are popular among gamers with nearly 82 per cent of mobile gamers in APAC preferring this method as it allows the user to control when and whether they want to watch the ad.

- Brand placements in games, though relatively new and expensive, is also being experimented. Chupa Chups has advertised across popular games like Angry Birds and Amiga Zool in this format.

- Other trending ad formats include interstitial ads and native banners.

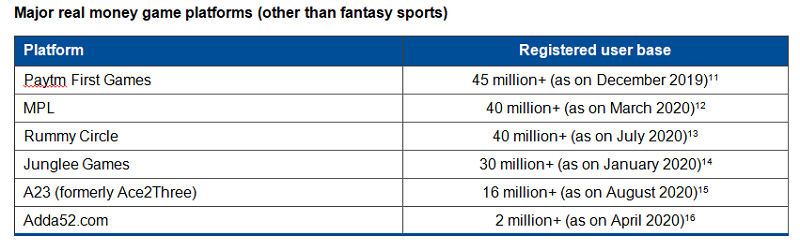

- Non-fantasy real money games continued to grow over FY20 and beyond; and witnessed the addition of newer formats. Card-based games which Teen Patti, Rummy and Poker continue to lead the segment due to their social connect and loyal user base. Among card-based real money games, Rummy commands largest share followed by Poker.

- Online fantasy sports is one of the most important sub-segments in online gaming in India, due to the high transacting user base, with the OFS contributing 25-28 per cent of the overall online gaming revenues in India in FY20.

- The number of fantasy sports platforms in India was estimated to be 140+ in CY2019, however, the increase in competitive intensity and COVID-19 impact is likely to ensure that we see some form of consolidation in the near to medium term.

- The top players which include Dream11, MyTeam11, My11Circle, Halaplay and Mobile Premier League account for more than 90 per cent of the market, both in terms of users as well as the Contest Entry Amount (CEA).

- The gaming industry has started to witness an increase in multi-gaming platforms that try to cater to the diverse entertainment needs of gamers with a mix of casual, real money and fantasy sports games available on the same mobile app. While some of the games available on multi-gaming platforms are developed by in-house teams, platforms also collaborate with other gaming studios and serve as a distribution channel for their popular games.

Gaming remains one of the fastest growing segments for the media and entertainment industry and is expected to benefit in the long run from the acceleration in consumption. Monetisation is likely to follow the increase in consumption with a lag as the fundamentals remain strong for the industry.

The segment would need to work around regulatory uncertainty, distribution challenges and improvement in the game economy to suit Indian audiences to ensure that gaming outpaces all the other segments in the near to medium term.

Here is the industry perspective:

“The Indian fantasy sports industry has come a long way from 10 operators in 2016 to 140+ in 2019 and 20L users in 2016 to 9Cr+ sports fans playing fantasy sports currently. This growth has primarily been fuelled by the developments in the Indian sports sector – the emergence of multiple sports, leagues, formats, and India’s rapidly improving digital infrastructure. Dream11’s Title sponsorship of IPL 2020 is a testament of how a digital fan engagement platform like fantasy sports is becoming integral to real-life sporting events. Fantasy Sports is bringing sports leagues and fans closer to each other by creating meaningful engagement,” said Dream11 and Dream Sports CEO and co-founder Harsh Jain

“Gaming as an entertainment medium has grown rapidly during Covid-19 pandemic. Inherent need for people to socialize along with large number of concurrent users on game platforms during times when social distancing norms are to be followed has led to evolution of games as community platforms. Gaming has also entered into the living rooms and has become a way of family entertainment,” said Nazara Technologies CEO Manish Agarwal.

“Gaming ecosystem has evolved considerably during last year with new and localised content for Indian gamers and emergence of esports streaming and hybrid apps. Games have also entered on OTT platforms wherein they are deployed as engagement tools with some monetization opportunities. Such new crossovers will further grow the gaming habits in India,” said Yoozoo Games India CEO Anuj Tandon.

“The gaming industry has changed rapidly over the last three to five years in India. Gaming has gained wider acceptance as a mode of entertainment and as a result has attracted more consumer spends over the years. The adoption of newer digital payment mechanisms like mobile wallets, UPI, etc. coupled with sachet-pricing and the use of data sciences have been critical elements for games to draw a larger share of the consumer’s entertainment wallet. An increasing willingness among gamers to pay online for entertainment is likely to drive growth for years to come,” said Octro CEO Saurabh Aggarwal

“Fantasy Sports platforms have been severely affected during the pandemic as sporting events have either been postponed or cancelled. There has been a massive drop in active users between March to June due to the lack of engagement options. While some operators have added multiple hyper casual games, we have added sports quiz to engage our users while ensuring the user experience remains centered around sports. However, with live sports activity commencing from June, we are expecting active user base and engagement levels to catch-up quickly,” said BalleBaazi co-founder and CEO Saurabh Chopra.

“Deeper penetration of digital payments has been the catalyst of growth for the gaming industry. Real money games, in particular, have immensely benefited as digital payment mechanisms like UPI made purchases friction-less and drove greater consumer spends on games. The future growth in the real money games segment, though, is likely to be driven by new innovative games that can be legally qualified as skill-based games,” Junglee Games founder and CEO Ankush Gera

“There is a fine balance between simplicity and depth in a game – it is simple to get a new user on the game and casual games have done well on getting users onboard. However, once the user is familiar, depth in gameplay is needed to keep the gamer engaged and monetize better. This depth in gameplay can empower developers to tap into in-app purchases with the purchase of virtual goods fast changing into a habit for gamers of the new generation. This spending habit among new generation gamers is expected to drive massive growth for the gaming industry in India,” said Hitwicket co-founder and VP – growth Keerti Singh.

“The challenge of sideloading the game still exists as everyone doesn’t know how to side load and people still need to understand that downloading an app from another platform is not illegal. However, this friction is less within a single multi-gaming platform. Referral of users does help in wider adoption of the platform as it allays the worry of sideloading,” said WinZO CEO Paavan Nanda.