The gaming industry in India has transcended mere entertainment to emerge as a powerhouse within the media and entertainment sector. Surpassing filmed entertainment, it now stands as the fourth largest segment, showcasing its undeniable impact and potential. With a staggering 455 million gamers, of which nearly a quarter engage with online games daily, the industry’s influence is undeniable.

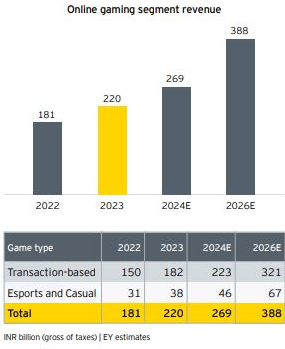

Looking ahead, the trajectory of growth remains promising, with projections indicating a sector worth a whopping Rs 388 billion by 2026. Despite some administrative challenges in certain regions, the overall outlook is optimistic. This is fueled by a shifting market landscape, characterised by a growing willingness to invest in online gaming and an expanding user base, poised to propel India to the forefront of global online gaming dominance.

Moreover, the evolution of online gaming has transformed it into more than just a casual pastime. It has become a viable career path for many, with individuals transitioning into full-time gaming professionals. According to the recent FICCI-EY 2024 report titled ‘#Reinvent – India’s Media & Entertainment Sector is Innovating for the Future’, the sector experienced a remarkable 22 per cent growth in 2023, achieving a total estimated revenue of Rs 220 billion (a significant leap from the Rs 181 billion recorded in 2022). This revenue comprises transaction-based games accounting for Rs 182 billion, while esports and casual games contribute Rs 38 billion.

Here are the key findings of the FICCI-EY Report 2024:

1) Online gamers grew eight per cent in 2023

- Online gamers in India grew to 455 million in 2023 and are expected to reach 491 million by 2024.

- Apart from the growth in smartphone users in India of over 30 million, low data charges and increasing per capita income, the popularity of gaming influencers (which attract significant followers on social media and short video platforms) contributed to attracting new cohorts of players.

- Battlegrounds Mobile India (BGMI), a version of PUBG Mobile exclusively available in India, was relaunched in May 2023 after being banned for over two years. It has since then garnered the top rank in app store downloads in India and has around 100 million cumulative players.

- The proximity to online games increased in 2023 from just gaming apps to media apps (entertainment, sports, news and music), social apps and e-commerce apps, as gaming was found to help with stickiness and aid in marketing content.

- With online gaming players now being charged 28 per cent GST on the full face value since 1 October 2023, there was a sense of fear that this would deter gamers playing online real money games. However, online gaming companies reworked their business models to either absorb or minimise the impact to gamers, and we understand that for large companies, the impact was felt for a short period of less than a quarter during 2023, though smaller gaming companies did wind down operations.

2) Hyper-casual games were most downloaded

- Hyper-casual games were both most downloaded, but had a minimal share of in-app purchases.

- Simulation games had the highest revenue share among the top five genres of games.

- In the case of casual games, the platform strategy worked and increased the customer stickiness and lifetime value, as gamers stayed on the platform for longer across more number of games.

- Some casual game companies we interviewed had 80 per cent of their consumers from non-metro markets.

3) Transaction-based game revenues crossed Rs 180 billion

- About 90 million gamers reportedly paid for online games in 2023.

- Transaction-based game revenues increased by 21 per cent to reach Rs 182 billion.

- Growth in rummy and poker was driven by:

- Rummy was permitted again in Tamil Nadu, always a key market, and new markets like Odisha opened up.

- Growing interest in online competitions with significant cash rewards

- Easy accessibility, connectivity, payments, withdrawals

- Growing awareness and comfort to transact online

- Incentives to attract and retain players

- Fantasy sports grew on the back of the IPL and the CWC, where India’s performance drove both viewership and game play. In addition, fantasy sports provided a vast array of emerging sports including football, basketball, kabaddi, etc., which enabled it to gain visibility and an increase in users.

- As per EY-LOCO gamer survey, 58 per cent of respondents were ok to spend money to play real money games while 52 per cent of respondents had paid to play fantasy sport in 2023.

- Google’s decision to permit listing of skill-based real money games on its app store has widened the reach for many other games that charge participation fees, and this segment saw 20 per cent growth.

4) Casual gaming grew 24 per cent in 2023

- In-app purchases

- In-app purchases revived significantly due to the launch of BGMI during 2023.

- Shooting and Strategy are the top two game categories where gamers spend

- Younger gamers are more inclined to play party, simulation and shooter-based games

- Older games continue to drive mobile game monetisation, too.

- Advertisement

- At a 100 million DAU, gaming provided a significant opportunity for brands to connect with upwardly mobile young audiences, though yields remained low.

- In 2023, the hyper-casual category saw the highest number of new games released and the most downloads, with many incorporating advertising revenue into their business model.

- Esports

- With multiplayer games making a comeback, prominent esports titles almost doubled to 19 in 2023, with 1.8 million Indians participating in them, and which were available across 20 platforms.

- Game streamers also saw an increase in viewership of 20 per cent to 25 per cent, particularly in Tier-II cities.

- As per the EY-Loco gamer survey, 78 per cent of respondents had participated in esports events and they all viewed at least one tournament a month.

5) Shooting games were most monetised

- Shooting games remained the favourite in India, generating 24 per cent of in-app purchase revenues, followed by strategy games.

- Relatively newer genres like match and party aggregated over 20 per cent of in-app purchase revenues between them.

- The top apps from a monetisation perspective in India in 2023 were:

6) Game viewership continued to grow

- Game platform Loco has estimated that online viewership grew 20 per cent in 2023.

- It believes that four per cent of total YouTube viewership is also related to gaming.

- Watch parties are growing, where groups of fans watch games together and interact with each other during game play.

7) India’s role in the international gaming landscape

- India is poised to become the world’s largest gaming hub.

- Digital Gaming India Expo 2023 saw participation from leading gaming companies across the world and showcased work on leading technologies like AR/ VR, blockchain, NFT, robotics, digital gaming, and more. India has seen the emergence of over 1,000 gaming studios and game development companies.

- Sony Interactive Entertainment (SIE) launched the Sony India Hero Project to support Indian game developers.

- The Krafton India gaming incubator fund has made an outlay of $50,000 to $150,000 per investment.

- Kratos Studios has committed to invest Rs 500 million to shortlist the first set of 10 to 15 studios by March 2024 to help them bring their games to the blockchain.

- Pune-based game development firm SuperGaming recently partnered with the US firm Epic Games to make its made-in-India battle royale game Indus, playable in Epic’s Fortnite.

Future Outlook:

1) The segment is expected to reach Rs 388 billion by 2026

- The segment is expected to grow at a CAGR of 21 per cent to reach Rs 388 billion, provided no retrospective tax actions are taken on the companies, on account of:

a) Smartphone users, who are expected to grow from 574 to 640 million by 2026.

b) Wired (or similar) broadband, which should almost double from 38 million to 68 million c) Growing per capita incomes and low data charges.

- The fastest growing segment would be in-app purchases (27 per cent CAGR), followed by fantasy sport (23 per cent) and then rummy and poker (19 per cent).

- Share of RMG will remain constant at around 83 per cent of the total revenues.

- In the event the key states of Andhra Pradesh and Telangana permit games of skill, and FreeFire is permitted to return, the growth can be higher.

2) Retrospective taxation can shut down the segment

- In the event the government continues with its desire to change taxation policies retrospectively, most gaming companies we met claimed that they would end up shutting down their operations as they would not be able to comply.

- The application of GST at 28 per cent on the face value of bets has already resulted in lay-offs and the closure/ sale of some small gaming companies.

- FDI will also revive only post the clarity on retrospective taxation.

3) Consolidation can be expected

- The impact of the GST regulation has resulted in gaming companies absorbing the impact to protect consumer traffic and spend, which has impacted margins significantly, putting a few smaller gaming companies at risk of survival.

- This will result in more deals in the segment in 2024, and we expect the market to stabilise with two to three fantasy sport players, one to two players each in rummy and poker, and one or two multi-game platforms.

- Once clarity on retrospective taxation is resolved, international interest will be significant, given limited opportunities for growth in foreign markets.

4) In-app purchases will grow significantly

- As the friction around digital payments reduces and as consumers’ willingness to consider gaming a digital phone offering grows, the ability to generate revenues from in-app purchases (both strategic and impulse buys) will increase.

- We estimate in-app revenues around casual games to double to Rs 28 billion by 2026.

5) Many new games will launch

- Several foreign games are expected to launch in India as game companies look for scale and a growing gaming audience, even at lower ARPUs.

- The implication of this will be improved game development, marketing and management services skill sets being built-up in India.

6) Gaming on ONDC and other apps

- Many CEOs EY team interviewed found the current play store charges eating into their profitability, and were looking for innovative ways to manage the same.

- Accordingly, EY sees many gaming companies using alternative models to collect subscriptions and in-app purchase revenues, and could look to alternate stores and collection platforms for the same, including web based play stores.

Here’s the full EY FICCI 2024 report titled ‘#Reinvent – India’s media & entertainment sector is innovating for the future.