Crafting captivating visuals is no longer just a skill; it’s a necessity for content creators striving for success in today’s competitive landscape. Despite facing challenges such as the 2023 writers’ strike in Hollywood, the India visual effects industry has been steadily gaining recognition and momentum in recent years.

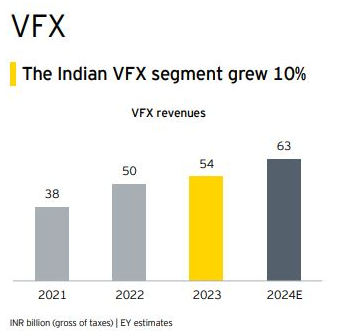

The FICCI EY Report, launched on 5 March 2024, unveiled that the Indian VFX segment exhibited a growth of 10 per cent, with revenues reaching Rs 54 billion in 2023, compared to Rs 50 billion in 2022, underscoring its resilience and potential. Projections indicate further growth, with revenues expected to reach Rs 63 billion in 2024 and Rs 83 billion by 2026, highlighting the industry’s promising trajectory.

The 2023 writers’ strike resulted in delays for over 48 films and 46 TV shows globally, impacting outsourcing volumes to countries like India, and leading to widespread layoffs within the industry.

The performance of the VFX segment was influenced by various factors, including cost management initiatives by major OTT platforms, which constitute a significant portion of the segment’s revenue. Nevertheless, domestic demand for VFX services remained robust, contributing substantially to the segment’s revenue.

Moreover, the utilisation of VFX and digital effects in advertising films emerged as a lucrative avenue, augmenting VFX revenue by 5 to 10 per cent. This underscores the diverse applications and potential growth opportunities within the VFX sector.

Although virtual production showed promise, its widespread adoption has been hindered by longer-than-expected ROI timeframes, high costs, and the rapid evolution of technology. However, as technology continues to advance and costs decrease, virtual production could become a more integral part of the industry in the future.

Here’s an overview of what took place in 2023:

1) International strikes led to delays and cancellations, impacting Indian VFX studios

- Writers Guild of America (WGA) and the Screen Actors Guild-American Federation of Television and Radio Artists (SAG-AFTRA) strike significantly impacted TV and film production, leading to consequences in India’s post-production and VFX segments.

- Production delays or suspensions impacted over 48 films and 46 TV shows during the strikes.

- Indian studios, typically dependent on international projects, adapted by seeking domestic collaborations and exploring other international markets to sustain operations and manage cash flows.

2) OTT budgets tightened

- In 2023, Disney+ achieved a US$4.5 billion reduction in its entertainment cash content spending as part of cost cutting measures.

- Reflecting the changing market dynamics and the impact of industry strikes, Netflix spent $13 billion on content in 2023, a decrease from the previously expected $17 billion.

- In 2023, it released 130 fewer original programs, a 16 per cent decrease compared to 2022.

- In the final three months of 2023, Netflix had its lightest slate of new releases in five years.

3) The domestic market remained resilient

- Despite international projects contributing approximately 70 per cent to VFX segment revenues, there was a notable increase in domestic revenue owing to increased uptake in VFX for even mid-sized films.

- Major Indian film productions, including Animal and Project K increasingly incorporated VFX, accounting for about 25 per cent to 30 per cent of their total project costs.

- Adipurush featured over 4000 VFX shots.

- Salaar employed more than 600 VFX shots.

- Redchillies.vfx worked on several large-scale films which were also some of the top-grossing films of 2023 like Dunki, Jawan, Animal, Pathaan, Tu Jhooti Main Makkar and 12th Fail.

4) VFX studios capitalised on the surge of CGI in commercials

- Advertising agencies increasingly used computer generated imagery (CGI) and digital effects to enhance ads, from subtle colour grading to complex CGI integrations

- VFX provided more creative freedom, flexible visual alterations, cost-effective production, and reinforced brand identity.

- In 2023, the global rise of CGI in advertising initially sparked by brands like Nike, gained momentum with Jacquemus and Maybelline, leading to its widespread adoption by both global and Indian brands.

- AJIO’s new collection reveal, Amul’s mascot reimagination, and Baskin Robbins’ logo revamp underscore 2023’s trend of CGI-led ads.

- Commercials contributed five per cent to 10 per cent of the VFX segment’s revenue, a figure poised for further growth and CGI adoption scales and more international brands entering India.

5) AI, machine learning, and real-time rendering transformed VFX

- Advancements in real-time rendering provided artists with instant visualisation of complex scenes, crucial for the interactive and iterative process of VFX creation.

- Increased adoption of AI and machine learning in VFX was noted. Benefits included efficiency and automation of tasks, like upscaling, accelerated CGI pre-visualisation and realistic motion creation.

6) Adoption of virtual production grew, but challenges remained

- India’s adoption of virtual production remained slower than in developed markets due to longer than expected break-even timelines.

- Despite keen interest, many Indian creators found it challenging to integrate this technology with traditional filmmaking practices.

- Virtual production studios in India were mainly utilised by local producers. Although there was interest from international clients, it did not translate into significant billable hours.

- Other challenges included the development of asset libraries (which demand significant time and financial investment) and skilled artists.

Future outlook:

1). Government incentives for exports will provide impetus to the segment

- The Indian government announced an incentive scheme for international animation, visual effects, and post-production projects using Indian services, with up to 30 per cent reimbursement on a minimum expenditure of Rs 10 million and an additional five per cent for significant Indian content. The incentive, capped at Rs 300 million per project, is to be applied for by the Indian service company involved in the project.

- The government also offers a 30 per cent reimbursement on qualifying production expenditures in India for foreign feature films, web shows, documentaries, and animation projects with Indian co-producers, capped at Rs 300 million per project. This incentive is disbursed on a first-come, first-served basis with a yearly limit of Rs 1.5 billion, and applications must be made by the Indian co-producer.

- These incentives are poised to boost the Indian animation and VFX segment’s global competitiveness and attract foreign collaborations.

2) Industry alliances will enhance global co-production and financing opportunities

- NFDC Film Bazaar partnered with Southeast Asian AudioVisual Association (SAAVA) and the ATF IP Accelerator Project Market (AIPA) for a multi-year collaboration, enhancing film and TV co-productions across Asia.

- The partnership encourages diverse international projects that could further increase demand for VFX services in the Asian market.

- This initiative, coupled with India’s film incentives, is poised to boost the animation and VFX segments.

3) Cloud and physical infrastructure build-out will assist global collaborations

- Cloud-based infrastructure enables animation and VFX studios to support remote working, allowing artists to access content and collaborate from different locations globally.

- The shift to cloud computing reduces the need for heavy upfront investment in physical hardware and software, offering a more flexible, usage-based pricing model.

- With cloud service providers managing technical aspects like performance and security, studios can concentrate more on the creative side of content production.

- In addition, proposed film cities being developed across UP, Maharashtra, Tamil Nadu, and others, will provide opportunities for large international studios to set up operations in fit-for-purpose locations.

4) Global cost rationalisation will provide an opportunity for India

- As the risk-taking appetite of global studios decreased in 2023, and they focused on creating top-end products at lower costs, the opportunity for India to increase its importance in the supply chain improved.

- We expect the use of government incentives, co-production treaties and the set-up of many international VFX studios to provide a significant opportunity for India to take advantage of the global environment.

- IT will also provide India a chance to build its own technological IP and differentiate our service offerings from other countries.

To read the EY FICCI 2024 report titled ‘#Reinvent – India’s media & entertainment sector is innovating for the future’, click here.