BENGALURU: Prime Focus Limited (PFL) reported 48.3 per cent growth in Income from Operations (TIO) in the quarter ended 31 December, 2015 (Q2-2015, current quarter) to Rs 316.67 crore from Rs 222.33 crore in the corresponding year ago quarter (quarter ended 31 December 2013, or Q3-2014) but was 10.7 per cent lower than the Rs 356.96 crore in the immediate trailing quarter Q1-2015 (q-o-q).

Notes:

(1) 100,00,000 = 100 lakh = 10 million =1 crore

(2) The company had filed results for a fifteen month period ended 30 June 2014, hence y-o-y comparison is being done between Q2-2015 and Q3-2014 and q-o-q comparison is between Q2-2015 and Q1-2015 (quarter ended 30 September 2014).

The company’s loss widened by Rs 36.17 crore in Q2-2015 as compared to the profit after tax (PAT) of Rs 10.33 crore (4.6 per cent of TIO) and a loss of Rs 22.01 crore in the immediate trailing quarter.The company says that loss for the quarter widened primarily due to non-cash tax charges, adverse FX fluctuation, residual exceptional integration expenses and finance charges.

PFL, in its earnings release for the previous quarter (Q1-2015), had said that loss for Q1-2015 had risen to Rs 22.02 crore because margins had been impacted primarily due to seasonal effects and due to significant duplication of costs in the creative services business in the first quarter post-merger. The company had initiated a global Integration process at its London, Vancouver and Indian facilities across both these entities. Consequently, the effects of the first phase of one time integration costs were also reflected in the financials claimed PFL. In its current quarter earnings release, PFL says Global integration of DNeg and PFW was proceeding as expected, with major integration expenses already incurred.

PFL’s simple EBIDTA excluding other income and based on the numbers submitted by it to the stock exchanges at Rs 35.48 crore was 20.9 per cent less than the EBIDTA of Rs 48.88 crore in the year ago quarter, but was a whopping 67.4 per cent more than the Rs 21.19 crore in the immediate trailing quarter.

Let us look at the other numbers reported by PFL in Q2-2015

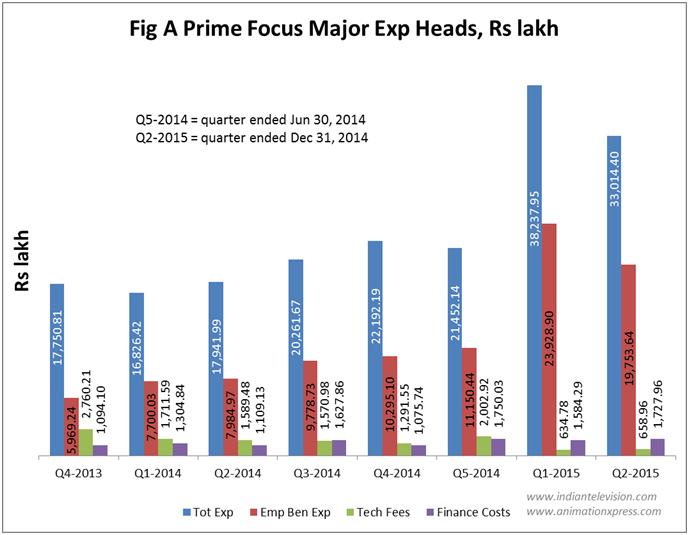

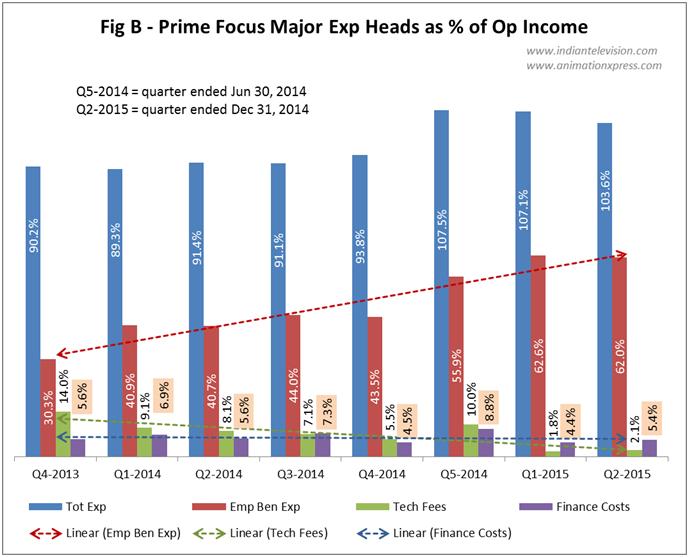

Figures A and B below show PFL’s major expense heads. As is obvious, a major expense head for the company is employee benefit expense or EBE.

PFL’s EBE in Q2-2015 at Rs 197.54 crore (62 per cent of TIO) was more than double (2.02 times) the Rs 97.79 crore (44 per cent of TIO) in Q3-2014 but 17.4 per cent less than the Rs 239.29 crore (114.6 per cent of TIO) in Q2-2015.

Fig B indicates that EBE also shows a linear upward trend in terms of percentage of TIO over the eight quarters starting Q4-2013 until the current quarter Q2-2015. EBE has been the highest in Q1-2015 both in terms of absolute rupees and in terms of percentage of TIO during the period under consideration.

Finance and Interest cost in Q2-2015 at Rs 17.28 crore (5.4 percent of TIO) was 6.1 per cent more than the Rs 16.28 crore (7.3 per cent of TIO) and 9.1 per cent more than the Rs 15.84 crore (4.4 per cent of TIO) in Q1-2015.

PFL executive chairman and group CEO Namit Malhotra said, “We are pleased to report rebound in our EBITDA margins as the benefits of the global integration exercise post the PFW – DNeg merger start to deliver. The cost optimization efforts are becoming visible in this quarter itself and margins will further enhance with increasing revenue momentum. PFT has again delivered robust growth, as the BARC rollout in India and new global contracts continue to fuel expansion. Our merger with RMW FMS is also expected to close shortly post required approvals. Industry leading awards continue to recognize Prime Focus’ techno-creative leadership. We are very excited about the future, with our game-changing strategies delivering as expected.”

Click here for the press release

Also Read:

Prime Focus Q1-2015 revenue up 78%, loss widens to Rs 22 crore because of global integration process

Prime Focus FY-2014 pat Rs 33 Cr; deferred tax, forex loss contribute to Prime Focus Q4-2014

Reliance MediaWorks owns 60% shares in Prime Focus open offerce

Prime Focus disappoints for quarter ended 30 June, 2014