The development comes at a crucial juncture for DreamWorks Animation and its chief executive, Jeffrey Katzenberg, one of Hollywood’s highest-profile executives, who has sought to define a long-term strategy that would help the company counteract a recent spell of mixed box-office results.

Since spinning off from DreamWorks SKG and going public in 2004, DreamWorks Animation stock has largely risen and fallen on the box-office performance of its feature films, something Katzenberg has been trying hard in recent years to change.

Following a $32 per share offer from Softbank, the Dreamworks Animation board held an emergency meeting on Thursday, said The Hollywood Reporter. It said Nikesh Arora, a former Google executive and now head of the recently formed Softbank Internet and Media, liased with Dreamworks on the offer.

Following a $32 per share offer from Softbank, the Dreamworks Animation board held an emergency meeting on Thursday, said The Hollywood Reporter. It said Nikesh Arora, a former Google executive and now head of the recently formed Softbank Internet and Media, liased with Dreamworks on the offer.

Softbank is best known as operator of Japan’s scrappy, third-ranked cellular carrier. In 2013, it bought the number three US wireless carrier, Sprint, and earlier this year made a play for fourth-ranked T-Mobile USA.

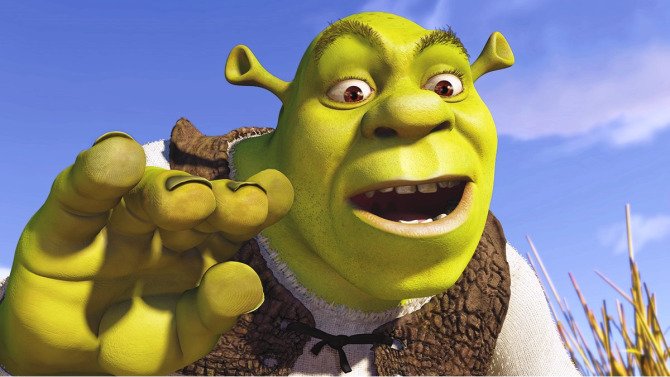

Dreamworks Animation is well known for its often humorous computer animated feature films. Some of the company’s biggest hits have included Shrek, Monsters vs. Aliens and Kung Fu Panda.

But, a string of box-office disappointments has severely depressed the company’s share price, forcing Katzenberg to assure investors that moves in industries like television, digital video and consumer products will help make the stock price less reliant on the two to three feature films the company releases annually.

DreamWorks Animation is also trying to reduce the cost of its film budgets, which exceed $100 million and require consistent hits to break even.

Three recent movies: Rise of the Guardians, Turbo and Mr. Peabody & Sherman incurred write-downs following weak box-office performances.

DreamWorks’s Animation latest release, How to Train Your Dragon 2, would be a highly profitable film for the company, Katzenberg said on a recent call with Wall Street analysts, though the movie’s domestic gross still fell short of expectations.

Katzenberg is in talks to sell his toon studio to the conglomerate. The deal would value DWA at around $3.4 billion, according to The Hollywood Reporter, which first reported the news. DWA currently has a market cap of nearly $1.9 billion.

Katzenberg would remain the head of DWA should the deal occur, with the exec signing a five-year contract to remain its CEO.