BENGALURU: Prime Focus Limited (PFL) reported 28.1 per cent YoY revenue growth for the quarter ending September 30, 2015 (Q1-2016, current quarter) at Rs 448.57 crore as compared to the Rs 350.17. However, QoQ, the company’s revenue declined 13.4 per cent from Rs 518.21 crore.

Notes: (1) 100,00,000 = 100 lakh = 10 million =1 crore

(2) The company had filed results for a fifteen month period ended June 30, 2014, hence YoY comparison is being done between Q1-2016 and Q1-2015 and QoQ comparison is between Q1-2016 and Q4-2015 (quarter ended June, 2015).

The company’s quarterly bottom line has been negatively affected due to significant exceptional costs primarily in relation to previously announced divestiture of PFL PLC and planned restructuring / integration costs in relation to the merger with Double Negative. In Q1-2016, this amounted to Rs 12.26 crore, in Q4-2015 it was Rs 159.29 crore and in Q1-2015 this figure was Rs 34.27 crore.

The company reported a net loss of Rs 22.51 crore in Q1-2016; a loss of Rs 22.01 crore in Q1-2015 and a loss of Rs 213.76 crore in the immediate trailing quarter, Q4-2015.

The company’s simple EBIDTA for Q1-2016 at Rs 52.07 crore (11.6 per cent margin) more than quadrupled (4.7 times) YoY from Rs 11.19 crore (3.2 per cent margin, but declined 39.6 per cent from Rs 86.17 crore (16.6 per cent margin) in Q4-2015.

Let us look at the other numbers reported by PFL

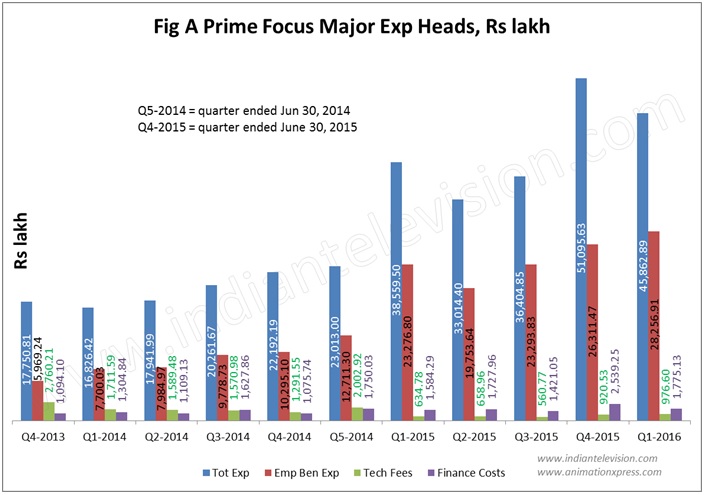

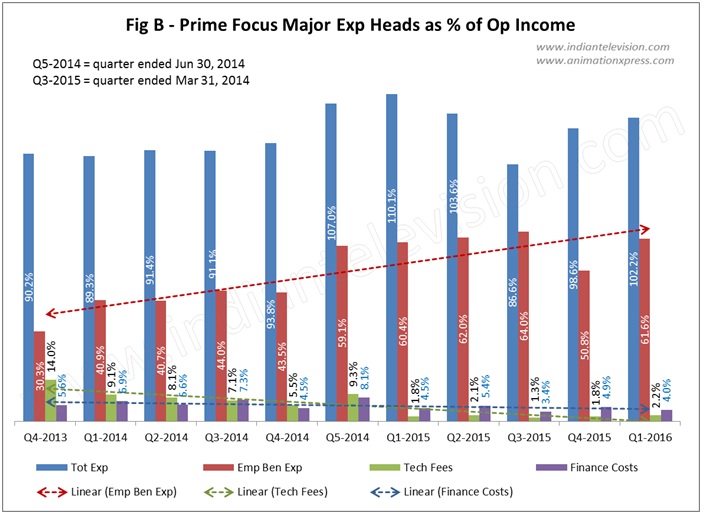

Figures A and B below show PFL’s major expense heads. As is obvious, a major expense head for the company is employee benefit expense or EBE.

PFL’s EBE in Q1-2016 at Rs 282.57 crore (61.6 per cent of TIO) increase 21.4 per cent YoY from Rs 232.77 crore (60.4 per cent of TIO) and increased 7.4 per cent QoQ from Q4-2015 at Rs 263.11 crore (50.8 per cent of TIO).

Technician’s Fees in the current quarter increased 53.8 per cent YoY to Rs 9.77 crore (2.2 per cent of TIO) from Rs 6.35 crore (1.8 per cent of TIO) and increased 6.1 per cent QoQ from Rs 9.21 crore (1.8 per cent of TIO)

Fig B indicates that EBE also shows a linear upward trend in terms of percentage of TIO over the eleven quarters starting Q4-2013 until the current quarter Q1-2016. EBE has been the highest in Q1-2016 (61.6 per cent) in terms of absolute rupees, but in terms of percentage of TIO, it was highest in Q3-2015 at 64 per cent.

Finance and Interest cost in Q1-2016 at Rs 17.75 crore (4 per cent of TIO) increased 12 per cent YoY from Rs 15.84 crore (4.5 per cent of TIO), but declined 30.1 per cent QoQ from Rs 25.39 crore (4.9 per cent of TIO).

Click here for Financial Statement