Art of animation has its own language that has global appeal. Beyond merely entertaining little ones, it has been the tool for storytellers across the media and entertainment industry. In today’s digital landscape, animated visuals have seamlessly integrated into realms as varied as healthcare, technology, education, banking, and beyond, facilitating enhanced communication and engagement. However, the animation sector experienced a downturn in 2023.

This decline can be attributed to significant developments in the mergers and acquisitions arena, coupled with production delays resulting from the global writers’ strike in Hollywood. These factors played a pivotal role in impeding project timelines within the animation segment. According to statistics provided by the FICCI EY 2024 report titled ‘#Reinvent – India’s media & entertainment sector is innovating for the future’, the Indian animation contracted by five percent and the revenue touched Rs 36 billion (in 2022 it was estimated to be Rs 38 billion).

Industry leaders remain optimistic that as we progress into FY24, demand and activity within the animation sector are poised to rebound, potentially reaching Rs 40 billion. This optimism stems from the recognition that demand and consumption patterns are continually evolving, promising a resurgence in the animation landscape.

Here’s an overview of what took place in 2023:

1) Potential mergers and a dip in ad revenue reduced the volume of new animation projects commissioned

- The merger between Warner Bros. and Discovery resulted in a significant delay of 18 to 19 months for green-lighting new animation projects, impacting both outsourced and domestic project

- In 2023, the release of new Indian IPs decreased to five, compared to 10 in the previous year.

- Prominent IPs included Abhimanyu ki Alien Family and Kanha – Morpankh Samrat released by Nickelodeon and Bharat Hain Hum.

- The Zee-Sony merger also resulted in a halt in project approvals for a year. Additionally, significant structural changes within Viacom18 had an impact on green lighting of new projects.

- Broadcasters also saw ad revenue fall with major broadcasters like Zee and Sony witnessing a 7.7 per cent and 11 per cent drop in ad revenue.

- Despite the current slowdown, industry experts anticipate a recovery in project approvals and production in 2024.

2) The slump in the domestic demand increased interest in international projects beyond traditional western markets

- Indian studios are increasingly participating in key international events such as MIPCOM, MIP TV, Annecy, and Kidscreen.

- This shift reflects their pursuit of global opportunities and aligns with new collaborative efforts in countries like Russia, Spain, Italy and the Middle East.

3) Cost-reduction strategies undertaken by OTT platforms impacted the volume of animation work outsourced to India

- Major OTT platforms like Disney+Hotstar and Netflix implemented efficiency measures during 2022 and 2023, leading to a noticeable effect on the outsourcing of animation projects.

- Netflix’s animation division is undergoing a restructuring, including job reductions. Netflix cancelled more than five animated shows in 2023, including Dead End: Paranormal Park, Agent Elvis, Captain Fall and Farzar.

4) YouTube remains the number one digital platform in India for animated content

- Globally, Netflix and YouTube account for 82 per cent of children’s content consumption, with YouTube alone contributing to 50-60 per cent of animated content consumption in India.

- Despite revenue impacts from COPPA regulations, studios maintain interest in YouTube due to its superior data analytics capabilities compared to television.

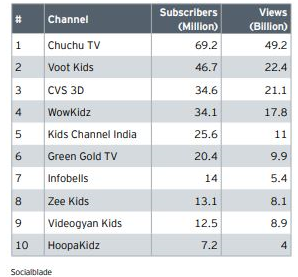

- Listed below are India’s leading YouTube channels for animated content:

5) Children’s media consumption shifted: Urban markets preferred digital platforms while TV dominated rural markets

- Continuing a trend from previous years, urban kids increasingly favoured digital platforms, while television remained dominant in rural areas.

- According to a recent survey, 26 per cent of parents considered television in their top three platforms for their children, with YouTube leading at 76 per cent and Netflix at 57 per cent.

- JioCinema’s entry into kids’ entertainment, featuring over 3,000 hours of Indian and global content in over five languages, is poised to boost digital viewership.

6) Anime grew and diversified

- India holds the second-largest anime fan base globally and is expected to contribute to 60 per cent of the worldwide growth in anime interest in the coming years..

- 12 million to 15 million kids in India watched TV shows every week that were anime-focused.

- Anime content constituted about 15-20 per cent of the TV programming schedule.

- JioTV has partnered to launch Animax in India, while Prime Video introduced the Animax+GEM pack, featuring a selection of popular Japanese anime, dramas, and variety programs with English subtitles.

- The popularity of anime in India has spurred an increase in merchandising and licensing.

- Sony YAY! acquired the rights to Naruto merchandise for India.

7) Content distribution strategies evolved

- Bharat Hain Hum was launched globally on Amazon Prime Video and Netflix and broadcast on Doordarshan in India.

- Mumbai-based kids’ YouTube channel PunToon Kids has formed a partnership with Doordarshan to broadcast its content on DD.

- This multi-platform evolution will benefit studios in terms of diverse revenue opportunities via broader reach of IPs.

8) Animation embraced AI, Unreal Engine, and cloud technologies

- AI is set to revolutionise animation by automating routine tasks, freeing animators to focus on creative aspects like character design and storytelling, which are expected to remain predominantly human-driven.

- Animation studios anticipate a threefold increase in efficiency and a rise in EBITDA by 10-15 per cent due to AI.

- Unreal Engine’s adoption increased due to its cross platform support and efficiency in animation, but a talent shortage prevented the segment from utilising its full potential.

- A growing trend was noted towards using cloud-based workflows, chosen for their efficiency, scalability, and enhanced security features.

Future Outlook:

1) Emerging opportunities in adult animation provide an opportunity for Indian studios –

- Between January 2020 and October 2023, the demand for adult animation in the US (excluding anime) surged by 152 per cent.

- The growth was approximately three times higher than the supply growth, indicating a strong market opportunity, particularly during a time of heightened production budget scrutiny.

2) The Asia TV Forum (ATF) and Ties That Bind (TTB) have formed a partnership to introduce the ATF x TTB Animation Lab & Pitch which aims to unite Asian and European producers, fostering exploration of new financing and co-production opportunities.

3) Studios will increasingly partner with universities and institutions to bridge the talent gap-

- To address the problem of finding and training the right talent, studios are forming partnerships with educational institutions.

- This proactive approach aims to cultivate skills from an early age, preparing for the increasing complexity of work outsourced to India.

a. FTII and Toonz Animation collaborated in offering animation and VFX courses at Pune, with plans for an incubation centre to encourage student-driven IP development.

b. Reliance Animation Academy partnered with Sandip University, Allen House, and Pimpri Chinchwad University for early-grade animation and VFX training.

c. Technicolor enhanced its training programs, both internally and at the Technicolor Creative Studios Academy, to support careers in audio visual, gaming and computer graphics, collaborating with government ministries to promote creative arts careers.

- A key gap that needs to be addressed is the ability of animators to understand the ‘acting’ component, not just the art.

- The approval of the National Centre of Excellence will also assist in this endeavour of developing talent.

4) Cloud and physical infrastructure build-out will assist global collaborations-

- Cloud-based infrastructure enables animation and VFX studios to support remote working, allowing artists to access content and collaborate from different locations globally.

- The shift to cloud computing reduces the need for heavy upfront investment in physical hardware and software, offering a more flexible, usage-based pricing model.

- With cloud service providers managing technical aspects like performance and security, studios can concentrate more on the creative side of content production.

- In addition, proposed film cities being developed across UP, Maharashtra, Tamil Nadu, and others, will provide opportunities for large international studios to set up operations in fit-for-purpose locations.

5) Build global IPs

- India has already proven itself capable of creating YouTube friendly content for global kids audiences.

- It is time for India to create film and OTT IPs that resonate globally, such as Mighty Little Bheem.

- The opportunities abound both from a mythology perspective as well as around various movie characters

Here’s the EY FICCI 2024 report titled ‘#Reinvent-India’s media & entertainment sector is innovating for the future’: