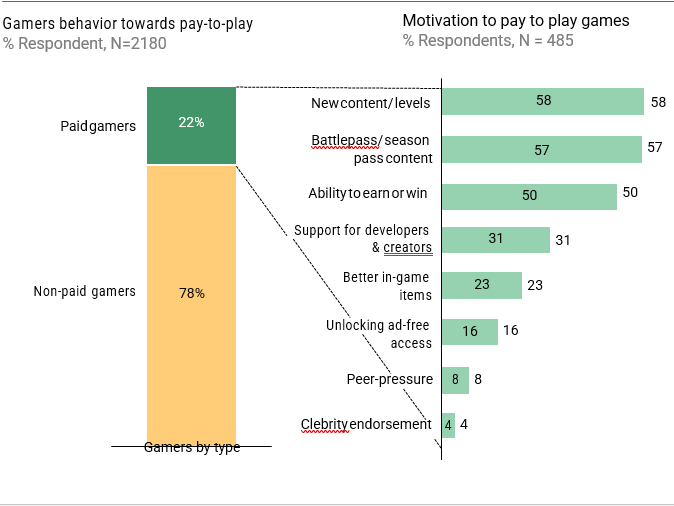

India’s gaming ecosystem is transforming at a fast pace because of which players are also becoming mature in respect to pay to play or in game purchases. Experts believe that the propensity to pay for games is driving the growth. In “India Gaming Report 2021 by Lumikai and Redseer” it has been stated that paid gamers in India are set to approximately become 235 million in 2025, from 80 million gamers in 2020 which will drive the growth of paid gamers.

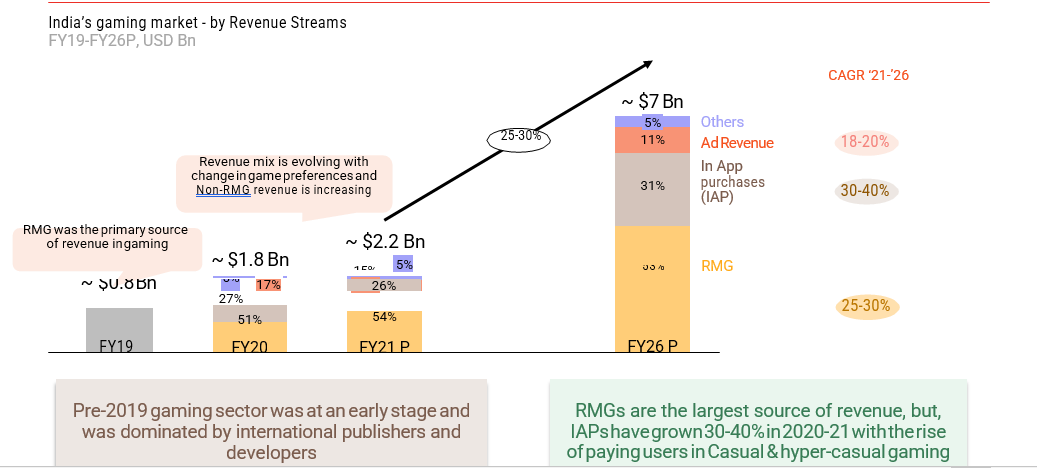

“This is an exciting time for the gaming ecosystem in India. Access to gaming is democratized with increasing participation from Tier-two cities and beyond, gamers are maturing in the way they play different gaming genres, and unprecedented growth in five years. While real-money gaming (RMG) will continue to dominate the market, in-app purchases (IAP), virtual gifting, so on to become mainstream spend categories among paid gamers, and the revenue from IAP is expected to outgrow overall India’s gaming market growth rate,” said RedSeer Engagement manager Mukesh Kumar.

“This inaugural report represents the most in-depth analysis of India’s gaming market ever undertaken, and the goal was to face the core assumptions on the true potential of the market. What has emerged is a picture of the market that already exceeds preconceived notions around size, growth, sophistication, and most importantly propensity to pay. India’s gaming market is due to 3x in value to over $7B by 2025, driven by a healthy diversity of monetization mechanics that indicate plenty of white spaces for new investment, and massive potential for a new generation of leaders across the gaming value chain. We’re excited to continue being at the forefront of India’s gaming investment landscape as the market matures and evolves to the next level,” said Lumikai Fund general partner Justin Keeling.

Here are the highlights of the report:

- India has approximately 425 Mn gamers and they play across three broad gaming channels and various game segments and genres including PC and Console gaming, mobile gaming and esports and game streaming.

- Number of casual gamers which is 350 million beats all other segments followed by core gaming (including midcore and hard core gamers) are 160 million, hyper casual gamers are 150 million, 15 million are RMG players and 30 to 40 million are for live streaming and tournaments.

- While real-money games are the largest source of revenue for the market, IAPs will grow faster for the next five years at 30 to 40 per cent with the rise of paying users in casual and hyper-casual gaming.

- Access to gaming in India is democratizing, with gamers coming from cities beyond metro and tier-one and playing mainstream gaming segments like mid-core.

– Under the hyper casual segment, 23 per cent of gamers are from tier one, 29 per cent of gamers from tier two and 48 per cent of gamers from metro.

– Under casual segment, 31 per cent of gamers are from tier one, 29 per cent of gamers from tier two and 40 per cent of gamers from metro.

– Under midcore segment, 33 per cent of gamers are from tier one, 33 per cent of gamers from tier two and 34 per cent of gamers from metro.

– For RMG 22 per cent of gamers are from Tier one, 24 per cent of gamers from Tier two and 54 per cent of gamers from Metro - Next wave of growth in gamers to come from tier-two+ cities and the factors that will drive the growth are: increasing smartphone and internet penetration, lowest data tariff leading to increase in data consumption, COVID impact leading to wider adoption of gaming, increasing vernacular offering and India-first content.

- In casual gaming, in-app purchases (IAP) have registered a 5X times increase. Casual games with social gaming feature performed better than games that didn’t have the feature.

- In social gaming, India saw a spike in adoption and growth in the social games; especially during the COVID lockdowns friends and family took to social gaming to maintain social connections.

- Gaming on smartphones has grown in popularity espec approximately 45per cent, compared to other digital media consumption like Video-streaming services.

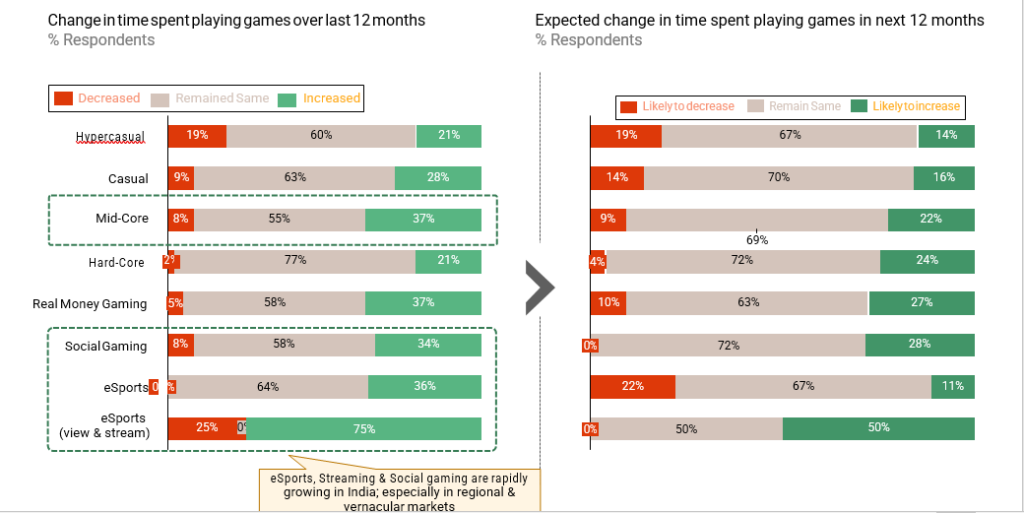

- Approximately 30 per cent users also claim that their usage of games on phones has increased during the past 12 months and for approximately 20per cent, it is likely to increase further as well.

- Further, non-RMG gaming segments are expected to grow faster than the market growth rate, with esports and streaming are expected to grow at 40 to 45 per cent CAGR for the next five years.

- Gamers are maturing in the way they play games. Usage of evolved forms of gaming (mid-core, social gaming and esports) increased in the last 12 months, a similar trend is expected in next 12 months. Esports view, game streaming and social gaming are rapidly growing in India; especially in regional and vernacular markets. In the next 12 months time esports and game streaming will continue to surge by 50 per cent.

- India has emerged as the fastest growing gaming market in the world with growth in new paying users (NPU) now at over 50 per cent. Factors that will continue to boost growth are: increasing maturity of gamers, comfort to pay online, UPI integration in gaming apps and so on.

- An average gamer spends $16-a-year on gaming, and it takes approximately a week to start paying to play games. The propensity to pay is growing as games are becoming more popular and engaging. Most of the spend in casual, mid-core and hard-core gaming is towards in-app purchase

- Apart from increasing maturity of gamers and their propensity to pay, gamers are embracing the trend of playing “India-first content” games – more than 60 per cent gamers are willing to play games with an Indian central theme or character like from mythology or celebrities and so on. As gaming penetration increases beyond metro cities and towards mid-to low-income individuals (called “Audience of the Future”), preference for games with “India-first content” are increasing due to its “relevance and familiarity”. Multiple gaming studios (e.g. All Star Games and Studio Sirah) have emerged that are building “India-first content” to tap the growing opportunity.

- India’s gaming market to become $7 Bn in FY2026 (more than 3X of market in FY2021), in-app purchases are the fastest growing revenue streams of the market– increasing number of paid users and their growing propensity to pay to drive the growth.