Nazara Technologies Limited, a diversified gaming and sports media platform, announced its un-audited standalone and consolidated results for the quarter ended 30 June 2022.

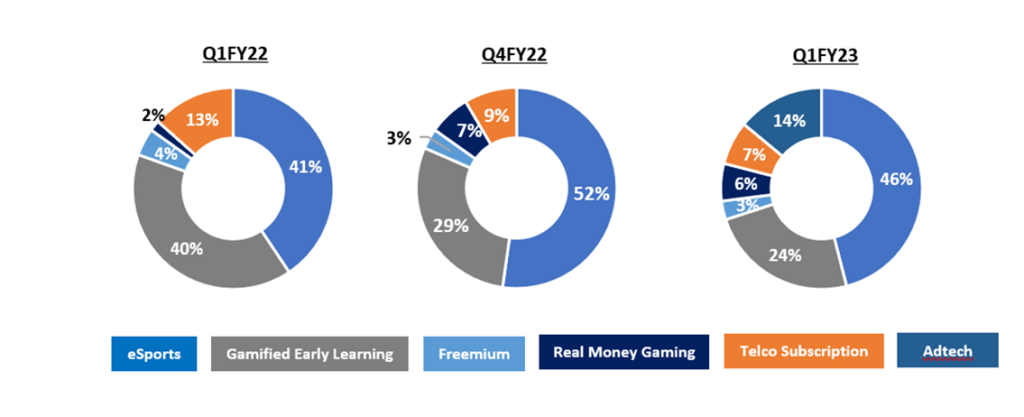

Nazara has an ecosystem approach to capture the large gaming opportunity, and has successfully scaled assets in esports, gamified early learning, freemium and ad-tech. The real money gaming business also continues to grow.

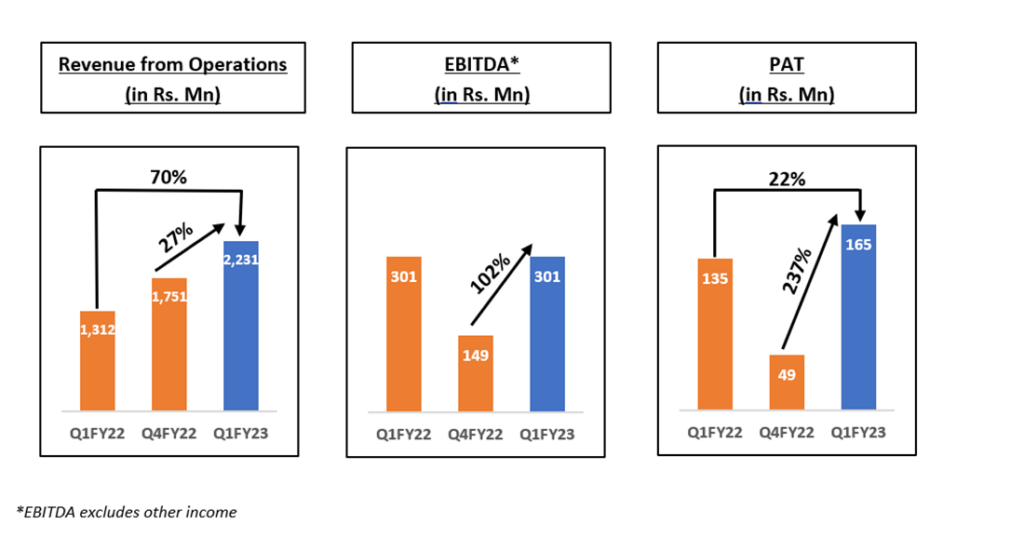

Key Consolidated Financial Highlights for Q1FY23 are as follows:

- Revenue increased by 70 per cent to Rs. 2,231 Mn as against Rs 1,312 Mn in Q1FY22 and a growth of 27 per cent QoQ

- EBITDA* stood at Rs 301 Mn as against Rs 301 Mn in Q1FY22, and growth of 102 per cent QoQ as the company invested in growth initiatives across its key segments

- EBITDA* margins stood at 13.5 per cent v/s 22.9 per cent for Q1FY22 and 8.5 per cent for Q4FY22

- Delivered a PAT of Rs 165 Mn, growth of 22 per cent YoY and 237 per cent QoQ

The company has a diversified and de-risked business model, with multiple levers of long-term growth. In this quarter, the company added another growth engine with Datawrkz, a US based advertising technology company. Consolidated Revenue Mix across business segments stood as follows:

Commenting on the Q1FY23 performance, Nazara Technologies CEO Manish Agarwal stated: “We are happy to report an all-round growth. The multi-pronged approach to capture opportunities have been yielding positive traction and we are in line with our target growth plans for FY23. The traction across businesses; Esports and Real Money Gaming witnessed strong growth while addition of new growth engine in form of Datawrkz has augmented well for the business. We have also seen stabilisation of unit economics for our Gamified Early Learning business.”

The overall revenue for Q1FY23 as against the previous year saw a healthy growth of 70 per cent, leading to a PAT growth of 22 per cent, year on year. On the operating margin front, we have made investments in our business segments that will provide us with robust growth opportunities in the years to come. The company will continue to look for growth opportunities both organically and inorganically. In particular, we are looking to augment presence in Freemium segment especially in developed markets.”