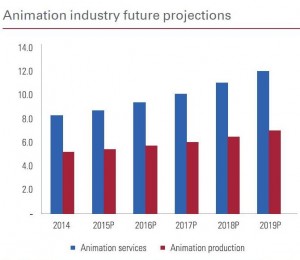

The FICCI KMPG report 2015 that was released at the FICCI FRAMES Event has seen a big chunk of focus and dedication to the animation, VFX, gaming and comics (AVGC) sector of India. 2014 saw the value of VFX grow the highest at 22 per cent, followed by post-production at 15 per cent, animation production at 9 per cent and animation services at 1 per cent.

An overall 13 per cent growth from Rs 39.7 billion in 2013 to Rs 44.9 billion in 2014 was majorly due to the unpredictable changes that came about last year. The animation industry witnessed a major box office success in Chaar Sahibzaade that earned Rs 332 million in India and the release of the first film shot with photorealistic performance capture technology Kochadaiiyaan. Of the 10 Oscar nominated movies, six had VFX done in India. Prime Focus bagged deals with Reliance MediaWorks and Double Negative.

Animation

Slowly, Indian animation production houses are realising the importance of developing their own IPs either on their own or in partnership rather than just depend on outsourced projects from mainly Hollywood. However, consumption of animated feature films has been low with not many projects recovering production cost. In 2014, Kochadaiiyaan and Mighty Raju Rio Calling failed to make a mark but Chaar Sahibzaade was the exception.

Made by Harry Baweja, Chaar Sahibzaade has made a record for the animation industry in India and also won a special award at the FICCI Frames BAF Awards 2015. The report has a case study on the movie, created by iRealities that took nearly five years to create at a budget of about Rs 200 million and raked in Rs 650 million globally with 45 per cent coming from overseas territories.

“The demand for animation content in India appears to be growing steadily over the last few years, following the success of international releases in India. The box office collection from India of these international films is minuscule when compared to overall collections; however, the numbers are encouraging. The performance of movies like How to Train Your Dragon 2 (HTTYD2), Rio 2, proves that there is indeed a potential market for animated films in India which is yet to be tapped,” states the report.

Gross collection from India in 2014 for HTTYD2 was Rs 169 million, Rio 2 was Rs 144 million, Big Hero 6 was Rs 30 million and The Lego Movie was Rs 16 million. The highest collection in 2013 was The Croods with Rs 93 million.

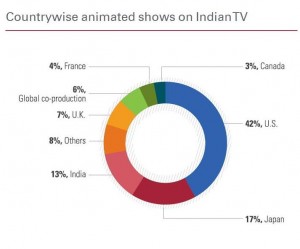

On the kids channels in India, domestic animation only constitutes 13 per cent of the content while majority is dominated by US made shows. However, the run time of local shows has been increased for popular ones such as Motu Patlu on Nick and Kisna on Discovery Kids. “Television continues to be the principal segment for domestic consumption of animation content in India. As India has one of the largest populations of kids watching cartoons in the world (approximately 200 million) the need for kids’ content is growing,” states the report. The viewership however has been steady for several years with 2014 accounting for 7.3 per cent for kids content.

On the kids channels in India, domestic animation only constitutes 13 per cent of the content while majority is dominated by US made shows. However, the run time of local shows has been increased for popular ones such as Motu Patlu on Nick and Kisna on Discovery Kids. “Television continues to be the principal segment for domestic consumption of animation content in India. As India has one of the largest populations of kids watching cartoons in the world (approximately 200 million) the need for kids’ content is growing,” states the report. The viewership however has been steady for several years with 2014 accounting for 7.3 per cent for kids content.

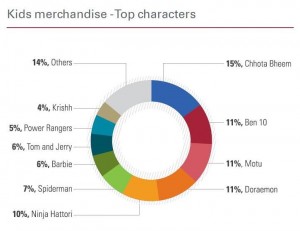

The viewership trend for the year shows that the kids of today are increasingly inclined towards local content. The annual Ormax study shows that five out of the top 10 popular characters are created by Indian studios including Chhota Bheem, Hattori, Motu, Patlu and Kid Krish.

Channels have adopted a two-fold strategy to building kids brands, first by developing a range of loveable characters and then to drive brand engagement beyond TV, through on-ground events, online and mobile platforms, consumer products etc. Advertising brands also took popular characters to engage with the youngest audience such as Honda launches safe riding campaign with ‘Chhota Bheem’,

Kellogg signs unique promotional deal with ‘Chhota Bheem’ TV series, Parle Products ropes in ‘Tom and Jerry’.

Green Gold Animation founder and CEO Rajiv Chilaka said in the report that improved software and digitization has cut down on man-hours and improved quality and precision. “The Indian animation industry is going through the transition phase where producers are contemplating about aiming at the international markets with big budgets and high quality products. The path to international success lies in producing good quality movies with smaller budgets of Rs 60 million to Rs 100 million for the domestic market and then tying up with an international distribution agency,” he said as the recipe to success.

Licensing & Merchandising

KPMG estimates that organised retail in India is expected to grow from 9 per cent in 2015 to 20 per cent by 2020 with a good push being given to the merchandising industry too.

The report states that brands should introduce products only when characters are sufficiently popular. “The focus should be on creating long term relationships with licensees where the characters are converted into brands as they mature and once mature, can be exploited through the consumer products business; the characters then are timeless and not just a flavour of a season,” it states.

The report states that brands should introduce products only when characters are sufficiently popular. “The focus should be on creating long term relationships with licensees where the characters are converted into brands as they mature and once mature, can be exploited through the consumer products business; the characters then are timeless and not just a flavour of a season,” it states.

India also lacks a robust retail ecosystem with only Green Gold having its own stores across the country. Piracy is also a crucial impediment to growth with KPMG putting the grey market at six times the retail market.

Outsourcing and co-production

2014 wasn’t a spectacular year for the outsourcing industry due to increased competition from China and Far East countries. A new trend also emerged of modularization of animation where experts from multiple animation studios come together to provide service in specific parts of the value chain. This model which is popular in the mature markets is being adapted by local studios to save time and gets good quality.

Studios in India can tie up with studios abroad to leverage on each other’s expertise by sharing the IP rights and revenues. This gives Indian studios a foot in the global market and also allows the two companies to take advantage of the benefits available in the other market.

Challenges

There is a lack of awareness of animation as a career and lack of training in the field. While sketching can be honed over time, the art of animation can only be learnt. The curriculum of the few animation schools aren’t up to international standards.

“Lack of education in animation concepts, storytelling, and production pipeline delivered late hindered the growth of the industry. Also the fact that studios are competing among themselves instead of competing as a cohesive group internationally; this along with using pirated technology has hampered the industry a lot,” said Madmax CEO Madhavan.

The Indian players lack government support for favourable policies. The Indian mindset is still skewed to animation being a kids content only.

2014 was a testimony to the inclination of Indian audience towards domestic content across mediums. This has necessitated the industry players to work more towards developing, producing and broadcasting new domestic content. While India will continue to be a cost effective and high quality delivery partner for providing outsourcing services to global animation market, timely government impetus could propel this segment to the next level.