Thanks to the 2020 Covid-19 pandemic, the Indian gaming scenario has observed positive growth as many opted gaming to pass their time in that duration. Since then there’s no going back, it is one of those industries which is on constant rise from all aspects. Online gaming and esports have observed unprecedented growth in the last two years and people are choosing gaming as a full-time profession. The recent FICCI-EY Media and Entertainment report 2023 ‘Windows of Opportunity’ states that online gaming in India can grow to INR 231 billion by 2025 at a CAGR of 20 per cent over four years.

Here are the key findings of the FICCI-EY Report:

Overall online gaming growth

- The online gaming segment grew 35 per cent in 2022 to reach INR 135 billion. It is the fourth-largest segment of the Indian M&E sector

- The count of online gamers in India grew to reach 421 million in 2022 and of these, around 90 to 100 million are frequent players of games

- Transaction-based game revenues grew 39 per cent while casual gaming grew 20 per cent

- Transaction-based game revenues crossed INR 100 billion

- Fantasy sports growth was driven by the resumption of sporting events, including some marquee events like FIFA, Asia Cup, IPL and T20 World Cup

- Close to 25 per cent of online gamers are paid gamers

- Online game viewing and streaming became an alternate entertainment option to OTT consumption and social media

Online gamers

- The count of online gamers in India grew to reach 421 million in 2022 and is expected to reach 442 million by 2023

- Gaming influencers such as Total Gaming (33.5 million subscribers), TechnoGamerz (31.5 million subscribers), CarryisLive (11.6 million), Live Insaan (9.86 million) have attracted new cohorts of players

- Greater online gaming awareness through marketing and the use of brand ambassadors like MS Dhoni for WinZO, Shah Rukh Khan for Ace23, Hrithik Roshan for Games 24×7, and Virat Kohli for MPL also contributed to an increase in awareness and trial

- Ecom-Gaming category advertising volumes on television increased two folds between Jan-Aug’22 as compared to Jan-Aug’21

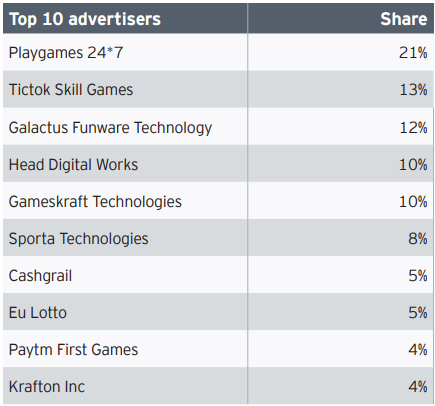

- The top 10 advertisers in the ecom-gaming category were:

- The development of broadband connectivity in Tier-II and Tier-III cities, along with cheaper data costs and affordable smartphones, has also contributed to the growth of online gamers

- It is estimated that over 60 per cent of internet users converse in regional languages. Hence, many game developers in India have started offering games in regional languages, along with Hindi, such as Gujarati, Marathi, Tamil, Telugu, Kannada, Bengali to attract them

Casual gaming

- Casual gaming grew 24 per cent in 2022

- Esports popularity is growing and has seen a surge in players, spectators, sponsors and prize pools despite a government ban on several popular esports games. eTigers were the first Indian team to qualify for the global competition, FIFAe Nations Cup

- As per the EY-Loco gamer survey 2022, 61 per cent of respondents had participated in esports events and they all viewed at least one tournament a month

- InMobi’s platform data showed that 34 per cent of all ad spends were on game apps between January and July 2022, and there has been a 60 per cent year-on-year growth in the volume of advertisers investing in mobile game advertising

- As per the EY-Loco gamer survey 2022, 45 per cent of respondents spent over an hour per game-playing session and around half were willing to pay for in-app purchases. As online gamers are maturing and moving beyond casual gaming habits to serious gameplay, it is resulting in higher in-app purchases

Revenues

- Transaction-based game revenues increased by 39 per cent in 2022 from 2021, where they had grown 27 per cent crossing INR 100 billion

- Fantasy sports growth was driven by the resumption of sporting events, including some marquee events like FIFA, Asia Cup, IPL and T20 World Cup. The user base for fantasy sports is estimated to have grown by at least 14 per cent in 2022

- The propensity of Indian consumers to pay for online games is increasing YoY, with India’s percentage of first time paying users increasing to 67 per cent in 2022

- Close to 25 per cent of online gamers are paid gamers and increasing by approximately 2 million per month

Regulatory environment

- The Ministry of Electronics and Information Technology (MeitY) proposed amendments in the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules, 2021 under the Information Technology Act, 2000 to regulate online gaming (‘Amendment Rules’) and safeguard the users

- These rules are applicable to any intermediary that offers one or more than one online game

- The introduction of formal online gaming rules will enable privacy and security for gamers’ information and can aid in the increase of online gamers due to increased transparency

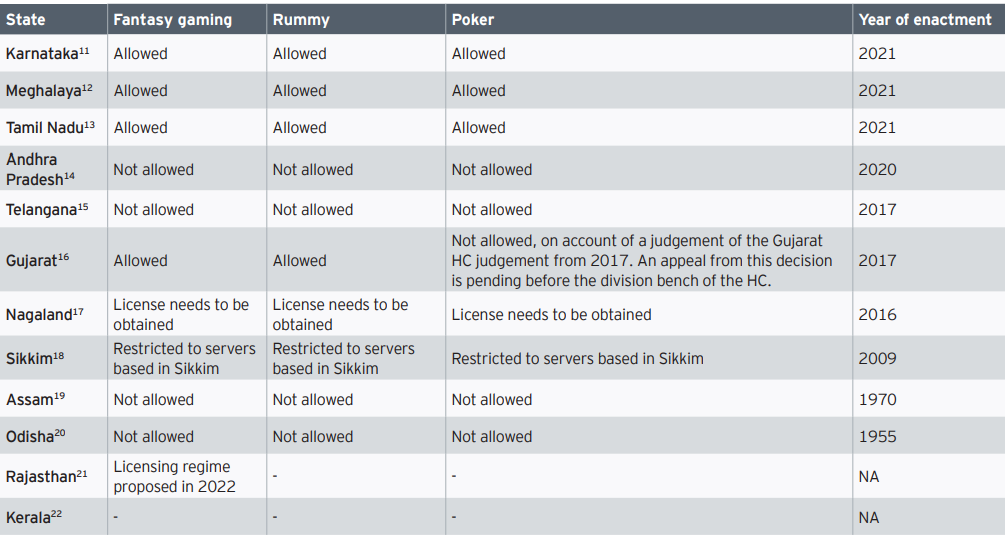

The stance of different Indian states on online gaming:

Future outlook

- Transaction-based gaming is estimated to grow at a CAGR of 21 per cent to reach INR 183 billion and contribute 79 per cent of total segment revenues

- Casual gaming will grow at a CAGR of 15 per cent to reach INR 48 billion

- Brands are now exploring online gaming worlds to launch products, hold events and enable new monetization opportunities

- Brands will continue to leverage gaming audiences through innovations in product awareness, product or service trial/ experience, bookings and after-sales service

- With 5G services being introduced, the opportunity for cloud gaming as a medium to experience higher-end games, on regular devices/ handsets is set to grow

- This shall also enable the evolution towards AR/ VR in games

- The recent trend of leveraging video games to create media content is now becoming popular

- As per the report, premium content (films and OTT series) based on games will generate 20-30 hours a year going forward

- With the split of sports media rights across four major broadcasters, the opportunity for play-along games will increase significantly

- In addition, the growth of DOOH screens (now in excess of 80,000 in India) will result in mass gaming using image recognition, QR codes, and others

- Web3.0 gaming, based on blockchain technology, can enable businesses to effectively target and connect with their audience and reward users for their contributions

- Globally, Web3.0 is expected to be USD 81.5 billion in 2030 growing at a CAGR of 43.7 per cent and the Play-to-Earn NFT games market is expected to be worth USD 2.85 billion by 2028 growing at a CAGR of 20.4 per cent between 2022 to 2028

- The report expects there will be over 50 large online gaming tournaments in 2025

- Given the relative certainty in the regulatory environment, the report expects the FDI to increase in the Indian online gaming segment

As per the data stated, it seems there’s no stoppage to the online gaming sector and growth is guaranteed.