There has been a burgeoning growth in online gaming and gamers since the outbreak of the pandemic due to the work-from-home and school-from-home culture, and the consequent build-out of the laptop and mobile phone ecosystem. In 2021, the lockdown in the April-June quarter and two states removing their bans on gaming led to growth in gamers. However, as workplaces and schools opened up, many casual gamers returned to their earlier lives but the online gaming sector continued to grow. As per the recent FICCI-EY media and entertainment report 2022 on “Tuning into consumer,” the online gaming segment is expected to reach Rs 153 billion by 2024 at a CAGR of 15 per cent to become the fourth largest segment of the Indian M&E sector, driven by innovations across NFTs, the metaverse and esports.

Here are the key findings:

Overall Growth

- Despite people going back to work as the effects of the pandemic receded, and regulatory uncertainty, the online gaming segment grew 28 per cent in 2021 to reach Rs 101 billion. Online gamers grew eight per cent from 360 million in 2020 to 390 million. Real money gaming comprised over 70 per cent of segment revenues.

- There were over 100 M&E deals in 2021and most investment was made in digital media and gaming, with one marquee deal in TV. The M&E sector will grow Rs 707 billion to reach Rs 2.3 trillion in 2024. One of the key contributors to this growth will be online gaming which is adding seven per cent of the growth.

- Smart connected TVs will exceed 40 million by 2025, thereby ending the monopoly of broadcasters on the large screen and leading to around 30 per cent of content consumed on large screens to be social, gaming, digital.

- Online gaming will continue to grow and reach 500 million gamers by 2025 to become the fourth largest segment of the Indian M&E sector. The segment will grow across all its verticals viz, esports, fantasy sport, casual gaming and other games of skill, but revenue growth will be led by mobile-based real-money gaming applications across these verticals. Gaming event IP will come into being, in the form of esports leagues, national online gaming events and multi-game platforms where gaming will be united with social interaction and commerce.

- M&E, including news, books, music, video and gaming, contributes to over 75 per cent of data consumption in India.

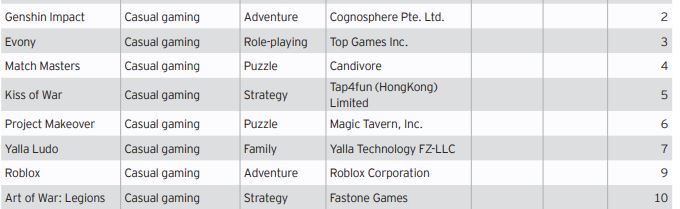

- In India, 26 games across 23 publishers contributed towards top-10 rankings across downloads, monthly active users and consumer spend. Action and racing oriented games remained the most popular in the top-10 rankings across all three parameters. Top mobile games in India in 2021 are:

- Streaming companies are hiring talent who have experience in the online gaming industry to drive their go to market plans in gaming. They face competition from established game developers as well as game streaming platforms like Google Stadia, Nvidia GeForce Now and Microsoft xCloud. This segment has a growing acceptance in India, with 13 per cent of smartphone-owning survey respondents subscribing to gaming platforms in 2021, up from one per cent in 2020.

- In Q3 2021 alone, NFTs witnessed $10.7 billion in sales globally, with game NFTs contributing 22 per cent of the total.

- Gamers have shown interest to invest in virtual events, skins, avatars and so on making NFTs a key component of the Metaverse economy.

- More than 500,000 Indian users have shown interest in NFTs as Bollywood celebrities and cricketers have entered the space.

Game consumer perspective

- Over 35 per cent of all apps downloaded in 2021 are gaming apps. Total of 9.3 billion gaming apps were downloaded in 2021, a growth of 65 per cent over two years.

- Number of game consumers have dropped down from 245 million in 2020 to 237 million in 2021.

- Users have spent $165 in 2021 on gaming apps with over 40 per cent of total spend in India in 2021 and a growth of 11 per cent over two years could be noticed.

- Online gamers grew eight per cent from 360 million in 2020 to 390 million in 2021; daily player range however was 90-100 million.

- The propensity of Indians to pay for gaming increased:

-Transaction-based game revenues grew 26 per cent on the back of fantasy sports and rummy.

-Esport and casual gaming revenues grew 32 per cent due to increased interest in esports and growth in in-app purchases.

- The number of paying gamers increased by 17 per cent from 80 million in 2020 to 95 million in 2021.

- India’s percentage of first-time paying users increased 50 per cent in 2021.

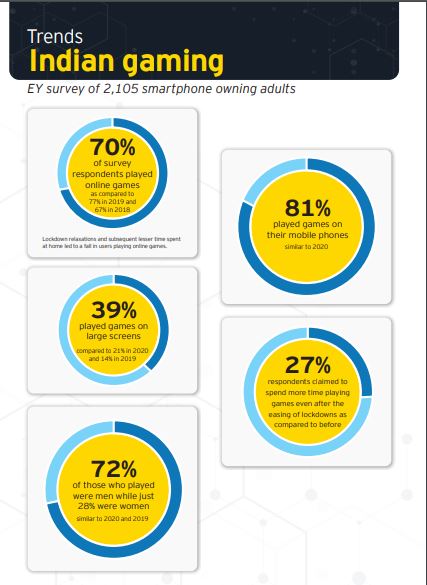

- 94 per cent of the casual gamers in India were mobile gamers.

- Seven to eight per cent of gamers playing casual games are estimated to be paying users.

- Growth in in-app purchases was at 40 per cent despite PUBG, one of the highest grossing games ever to be played in India, being banned for most of the year, clearly showing the willingness of Indians to pay within game environments as India based games like FauG and other international games like Free Fire (also subsequently banned in 2022) and Call Of Duty captured market.

- Advertisement revenue grew by 20 per cent as digital advertising picked- up pace across the board, though at very low rates.

- 85 per cent games by Indian publishers included advertisements on their platforms as compared to an average of 73 per cent for global games.

Esports Scenario - The number of esports players doubled from 300,000 in 2020 to 600,000 in 2021.

- Esports and casual gaming grew by 32 per cent in 2021. 94 per cent of the casual gamers in India were mobile gamers.

- Casual e-game revenues grew fastest at 58 per cent, albeit from a small base.

- sports revenue grew by 29 per cent from Rs 7.5 billion in 2020 to Rs 9.7 billion in 2021. Esports teams also grew by over 50 per cent from 60,000 in 2020 to 100,000 in 2021. The total prize money in 2021 crossed Rs 200 million and there is also a meteoric rise in viewership, from 600,000 hours in 2020 to two million hours in 2021.

- The growth seen in esports is expected to continue in 2022, with the number of players reaching one million, out of which 20 per cent would be women. India is expected to have 10 international esports teams by 2022. As a result, the interest of brands in this segment is increasing, with 72 brands investing in 2021 (up from 45 in 2020) and expected to reach 100 brands in 2022.

- Esports in India is being considered as an area for investment. Krafton, the company behind popular action-based games like PUBG and BGMI, invested Rs 1.64 billion in Nodwin gaming, India’s leading esports provider.

- India also saw multiple esports events with high prize pools, including that of Battlegrounds Mobile India Series (BGIS) by Krafton, with a total prize pool of Rs 10 million, the highest so far in the country. The total prize money in 2021 crossed Rs 200 million.

- There is also a meteoric rise in viewership, from 600,000 hours in 2020 to two million hours in 2021.

- India is also set to participate in the first ever Esports competition in the 2022 Asian Games with games such as the EA SPORTS FIFA branded soccer games, an Asian Games version of PUBG Mobile and Arena of Valor, Dota 2, League of Legends, Dream Three Kingdoms 2, Hearthstone and Street Fighter V.

Real money Gaming

- Being a state subject, regulatory uncertainty in several states led to intermittent access to markets during 2021, impacting real money gaming revenues.

- The count of online gamers in India grew to reach around 390 million in 2021 and is expected to reach over 450 million by 2023.

- Tier-III cities were a major contributor to this growth, with the top 30 tier-III cities reporting an increase of 170 per cent of gamers than in 2020.

- Rummy grew by 28 per cent and Poker grew by 23 per cent respectively in 2021. The user growth was fueled by an increase in the number of new gamers coming from northern India. Multiple key states like Karnataka, Tamil Nadu and Kerala removing the ban on transaction-based games will further boost this growth in 2022.

- Fantasy sports grew 26 per cent on the back of domestic sporting events like IPL, Kabaddi, Football, hockey and so on restarting after the pandemic as well as a heavy cricketing calendar of 36 matches across formats in 2021. The segment is on track for high growth, with the 2022 IPL season being played back in India after two years in UAE and with there being two new teams added in the league.

- India is now the largest fantasy sports market in the world, with key players being: Dream11, MPL, CricPlay, Halaplay, FanFight, 11 Wickets, MyTeam11, BalleBaazi.

Future predictions

- The online gaming segment to grow at a CAGR of 15 per cent to reach Rs 153 billion by 2024.

- Transaction based gaming will grow at a CAGR of 14 per cent to reach Rs 108 billion of this, comprising 71 per cent of total segment revenues.

- Medium and hardcore gamers would grow from around 100 million today to over 175 million by 2024, or around 20 to 25 per cent of online media consumers.

- Growth drivers will include increased internet subscribers, particularly the improvement of India’s low tele-density in rural areas, vernacular language gaming options, continued low-cost data plans and sustained economic and per-capita income growth

- In 2022, the metaverse refers to a fusion of video games, social networking and entertainment to create new immersive experiences like interacting and supporting your friends in games.

- Games like Roblox, Fortnite and Minecraft become stepping stones to grow the medium.

- Metaverse global market is predicted to grow to $800 billion by 2024.

- Metaverse will be enabled by fast internet connections (5G and 6G), powerful virtual reality (VR) headsets and a large audience of gamers.