Chipmaker Advanced Micro Devices (AMD) lowered its revenue estimate for the second quarter, below analysts’ average estimate, saying the demand for personal computers was weaker-than-expected.

“They are going through a big transition. It’s not a one quarter turnaround story, it’s going to take multiple quarters for the vision to come to fruition,” Wedbush Securities analyst Betsy Van Hees said.

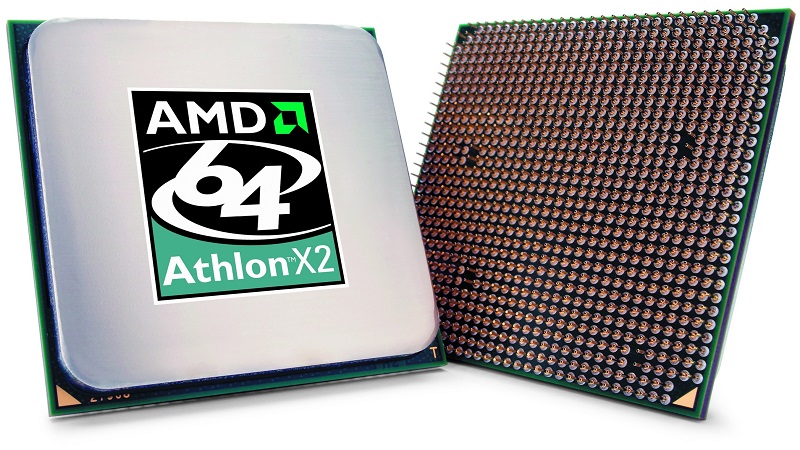

The company has been shifting focus to gaming consoles and low-power servers but progress has lagged Wall Street’s expectations due to intense competition from Intel and new competitors designing low-cost and power-efficient chips.

AMD was at the initial stage of reviewing whether to split itself in two or spin off a business, in a move to reverse its fortunes and take on Intel.

The company said on Monday it expects revenue to have decreased about 8 per cent from the first quarter, compared to its previous forecast of down 3 per cent, plus or minus 3 per cent.

This implies revenues amounting to $948 million, as against the $999.6 million as predicted by analysts.

The Sunnyvale, California-based company also cut its forecast for second-quarter adjusted gross margin to about 28 per cent, as weak demand from PC makers also hurt demand of its APU (accelerated processing unit) chips which combine both computing and graphic processing capability.

AMD had forecast margins of about 32 per cent. Van Hees said a weak PC market coupled with competition from Intel weighed on demand for the company’s APU chips.

AMD, which has an extensive cross-licensing agreement with Intel, has competed with the bigger chipmaker since the 1980s.The company warned in April that it expected weak demand for personal computers to continue for some time as original equipment manufacturers focus on lean inventories.