BENGALURU: Prime Focus Limited (PFL) reported 78.3 per cent growth in Income from Operations (TIO) in the quarter ended 30 September, 2015 (Q1-2015, current quarter) to Rs 350.17 crore from Rs 196.38 crore (quarter ended 30 September, 2013, or Q2-2014) and 76.6 per cent more than the Rs 199.5 crore in Q5-2014 (q-o-q).

Notes:(1) 100,00,000 = 100 lakh = 10 million =1 crore

(2) The company had filed results for a fifteen month period ended June 30, 2014, hence comparison is being done between Q1-2015 and Q2-2014 as well as Q5-2014 (quarter ended June 30, 2014).

The company’s loss widened to Rs 22.02 crore in Q1-2015 from the Rs 8.78 crore in Q5-2015. The company had reported a profit of Rs 21.34 crore (10.9 per cent of TIO) in Q2-2014. PFL, in its earnings release, says that loss for the quarter has risen to Rs 22.02 crore because margins have been impacted primarily due to seasonal effects and due to significant duplication of costs in the creative services business in the first quarter post-merger. The company has initiated a global Integration process at its London, Vancouver and Indian facilities across both these entities. Consequently, the effects of the first phase of one time integration costs are also reflected in the financials claims PFL.

Let us look at the other numbers reported by PFL in Q1-2015

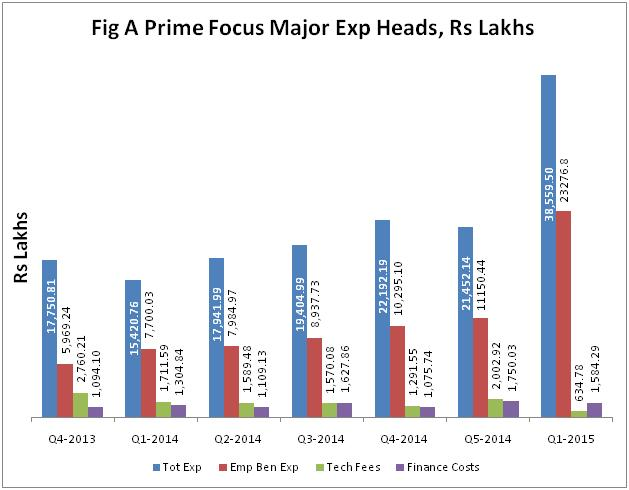

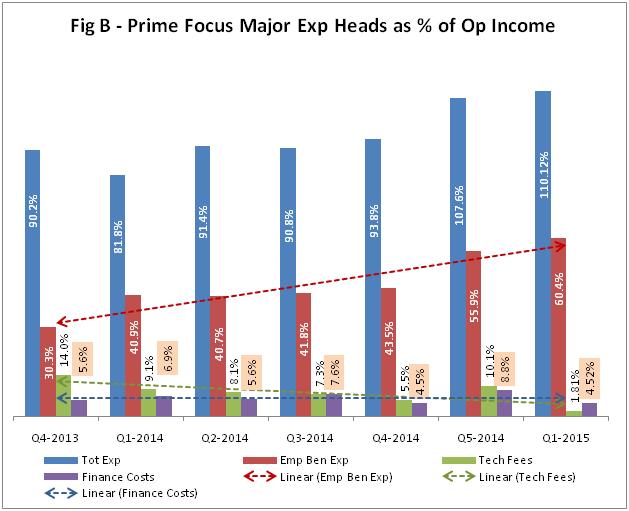

The company’s total expenditure (TE) in Q1-2015 at Rs 385.6 crore (110.1 per cent of TIO), which was more than double (2.15 times) the Rs 179.42 crore (91.4 per cent of TIO) in Q2-2014 and 80 per cent more than the Rs 214.52 crore (107.5 percent of TIO) in Q5-2014.

Figures A and B below show PFL’s major expense heads. As is obvious, a major expense head for the company is employee benefit expense or EBE.

PFL’s EBE in Q1-2015 at Rs 232.77 crore (60.4 percent of TIO) was almost triple (2.91 times) the Rs 79.84 crore (40.7 percent of TIO) in Q2-2014 and more than double (2.1times) the Rs 111.50 crore (55.9 percent of TIO) in Q5-2015. Fig B indicates that EBE also shows a linear upward trend in terms of percentage of TIO over the seven quarters starting Q4-2013 until the current quarter Q1-2015. EBE has been the highest in Q1-2015, both in terms of absolute rupees and in terms of percentage of TIO during the period under consideration.

Finance and Interest cost in Q1-2015 at Rs 15.84 crore (4.25 percent of TIO) was 42.8 percent more than the Rs 11.09 crore (5.6 percent of TIO) in Q2-2014 and 9.5 percent less than the Rs 17.5 crore (8.8 percent of TIO) in Q5-2015.

PFL executive chairman and group CEO Namit Malhotra said, “It has been an eventful quarter for us as a Group, where PFW (Prime Focus World) completed the merger with Double Negative (D-Neg) which we all are very excited about. At the same time, we initiated a significant integration and consolidation exercise across our global footprint”.

“These extra ordinary onetime costs juxtaposed with seasonally the slowest quarter in the Industry have had a major impact on our bottomline. The integration process with D-Neg has started well with the strategic assumptions playing out as expected. Post D-Neg integration, we are proud to announce that we have now become a fully integrated Tier I provider of creative services solutions globally. Our focus on cost stays high – we have shutdown our London and Vancouver VFX operations in PFW. The RMW’s FMS business merger is awaiting regulatory accelerated growth path we are extremely positive approval post which we expect to complete the transaction expeditiously. PFT is witnessing increasing traction for its products in the International markets and we are very excited about the growth opportunities there in addition to the continued momentum in India. With all our businesses on an accelerated growth path, we are very excited about the future, as you look beyond the one time integration costs, there are significant post-merger revenue and margin enhancement opportunities ahead,” added Malhotra.

Click here for the financial release

Click here for the press release

Click here for the notice of completion of RMW’s acquisition

Also read:-

Prime Focus disappoints for quarter ended 30 June 2014