BENGALURU: Prime Focus Limited (PFL) reported 80 per cent revenue growth for the year ending June 30, 2015 (FY-2015) at Rs 1607.59 crore as compared to the Rs 892.9 crore during the corresponding 4 quarter (12 month period) of the previous year. Last year, the company had reported revenue of Rs 1081.42 crore for the 15 month period ended 30 June, 2014.

Notes:

(1) 100,00,000 = 100 lakh = 10 million =1 crore

(2) The company had filed results for a fifteen month period ended June 30, 2014, hence YoY comparison is being done between Q4-2015 and Q5-2014 and QoQcomparison is between Q4-2015 and Q3-2015 (quarter ended 31 March, 2015).

YoY, PFL’s revenue increased by 2.4 times in Q4-2015 at Rs 518.21 crore as compared to the Rs 214.99 crore in Q5-2014.

The company’s yearly and quarterly bottomline has been negatively affected due to significant exceptional costs primarily in relation to previously announced divestiture of PFL PLC and planned restructuring / integration costs in relation to the merger with Double Negative.

The company reported a net loss of Rs 292.22 crore in FY-2015 and a loss of Rs 213.76 crore in Q4-2015. The company’s simple EBIDTA for FY-2015 at Rs 241.23 crore (15 per cent margin) was 22.6 percent more than the Rs 196.76 crore (19.1 per cent margin) for the 15 month period ended June 20, 2014. PFL says in its earnings release that EBIDTA for the 12 month period ended June 30, 2014 was Rs 179.6 crore.

EBIDTA for Q4-2015 at Rs 86.17 crore (16.6 per cent margin) was more than five times the Rs 14.29 crore (6.6 per cent margin) in Q5-2014, but declined 18 percent as compared to the Rs 105.15 crore (25 per cent margin) in the immediate trailing quarter.

Let us look at the other numbers reported by PFL

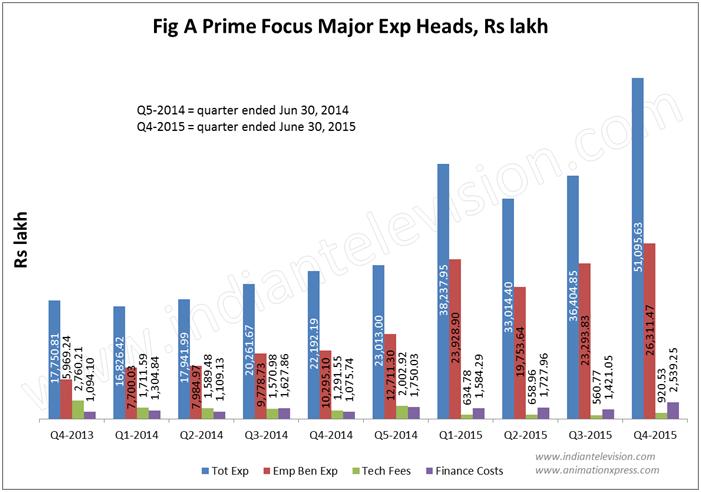

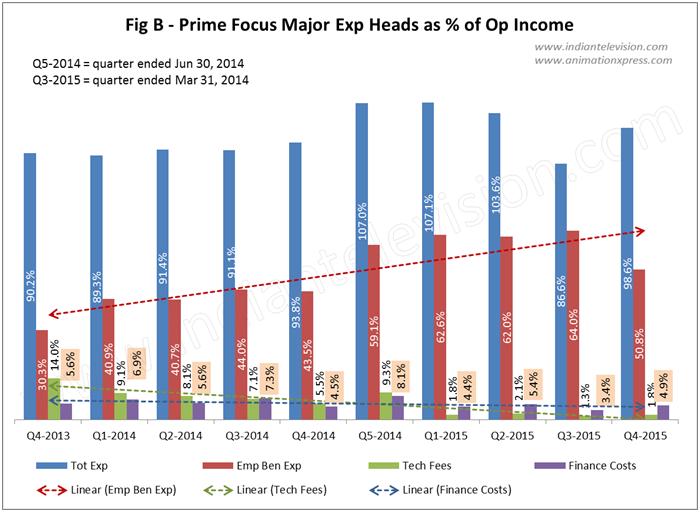

Figures A and B above show PFL’s major expense heads. As is obvious, a major expense head for the company is employee benefit expense or EBE.

PFL’s EBE in Q4-2015 at Rs 263.11 crore (50.8 per cent of TIO) was 13 percent more the Rs 232.94 crore (64 per cent of TIO) in Q3-2015 and more than double (2.07 times) the Rs 127.11 crore (59.1 per cent of TIO) in Q5-2014.

Fig B indicates that EBE also shows a linear upward trend in terms of percentage of TIO over the nine quarters starting Q4-2013 until the current quarter Q3-2015. EBE has been the highest in Q4-2015 in terms of absolute rupees, but in terms of percentage of TIO, it was highest in Q3-2015.

Finance and Interest cost in Q4-2015 at Rs 25.39 crore (4.9 per cent of TIO) was 45.1 per cent more than the Rs 17.50 crore (8.1 per cent of TIO) in Q5-2014 and 78.69 per cent more than the Rs 14.21 crore (3.4 per cent of TIO) Q3-2015.

Click here for Financial Result