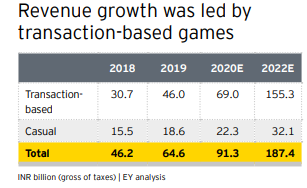

The FICCI-EY report ‘The era of consumer A.R.T. – Acquisition Retention and Transaction,’ that was recently launched found that Media and Entertainment (M&E) sector reached $25.7 billion in 2019, a growth of about nine per cent over 2018 and the online gaming segment retained its position as the fastest growing segment on the back of transaction-based games mainly fantasy sports, increased in-app purchases and a 31 per cent growth in the number of online gamers to reach around 365 million. This represents a 14x growth since 2010, when there were 25 million gamers. The online gaming segment grew 40 per cent in 2019 to reach Rs. 65 billion and is expected to reach Rs187 billion by 2022 at a CAGR of 43 per cent.

Online gaming growth was also enabled by:

► Increased popularity of fantasy games on the back of popular sports like cricket, which grew over 100 per cent since 2018

► Incentive to win money in transaction-based games coupled with a more pervasive mobile payments ecosystem

► Growth of over 20 per cent in casual gaming on mobile phones

► Online gaming in India is projected to grow faster than the global online gaming segment

►Gaming contributed nearly 6 per cent of time spent by users across content categories on mobile devices

►Women spent similar time on gaming applications as compared to men in India. Casual games that promoted relaxation, fun and connection were more popular with women, while competitive gaming also witnessed an increase in women participants

► By 2022, the estimated number of employees within the online gaming segment would be over 40,00011

► The online gaming segment also has the potential to bring in massive employment, through direct and indirect jobs that can be generated from ancillary sectors such as telecommunications, marketing, financial services and banking, technology, events and real estate

► Indirect tax collection from online gaming for 2019 could be in excess of Rs 9.8 billion, rising to Rs28.6 billion by 202213, apart from direct taxes

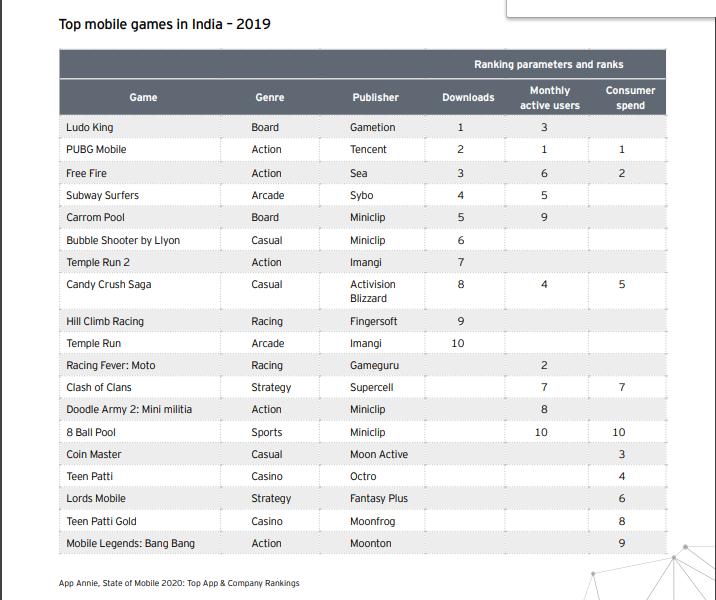

►India’s game downloads in 2019 increased 12 per cent over 2018 and amounted to 13 per cent of total game downloads worldwide

►In 2019, 5.6 billion mobile game applications were downloaded in India which is the highest worldwide.

►However, app store revenue from India was only 0.2 per cent of the global app store revenue

►Time spent on gaming ranked fifth highest on mobile devices

►Transaction-based games grew 50 per cent in 2019, led by fantasy sport games which grew by 118 per cent

FICCI conducted online gaming survey with 1,266 smartphone owning adults and the key findings are as follows:

- There has been 10 per cent increase in number of players compared to 2018 earlier 67 per cent of smartphone users played games and this year it has increased to 77 per cent.

- Among 59 per cent enjoying games as mode of entertainment whereas 31 per cent believes it acts as a stress reliever and 10 percent have other reasons to play games

- Number of in app purchases have also increased by 10 per cent as 15 per cent are willing to pay for in-app purchases.

- 74 per cent are ok to watch ads rather than pay to play which has increased from 70 per cent compared to 2018.

- 28 mins average time spent by users in gaming as most played between 15 to 30 mins a day and 76 per cent of the audience play twice a day

- 58 per cent prefer gaming post dinner time and 35 per cent prefer while travelling.

- For gaming 73 person preferred mobile devices while 14 person prefer large screens

Choice of games :

- People are preferring racing games(41 per cent), casual games(47 per cent), action and strategy games (61 per cent), and puzzels(44 per cent) as well.

- 46 per cent have played multiplayer games and 35 per cent have played fantasy sports

- 55 per cent have played games recommended by their friends and 43 per cent played popular games from the app store.

Global trends in gaming

According to the report here are the possible global trends can be predicted,they are as follows:

Legal sports gambling goes mainstream

Following the US Supreme Court’s decision of removing the Professional and Amateur Sports Protection Act in 2018, casinos, media companies, sports leagues, online gambling operators, fantasy sports start-ups and software providers have emerged as early winners in the market. Specifically, gaming operators have been ironing out massive contracts between professional sports leagues and individual teams which appear to be quite lucrative. Since the first legalization of sports betting, further legislation to authorize sports betting has passed in 13 states. Five more states and the District of Columbia are poised to start legal markets in the coming months, and similar bills are being considered in many other states.

Cloud gaming takes off

After mobile gaming expanded the market by making games accessible to billions of people across the globe (it remains the largest segment in 2019), cloud gaming offers a similar huge potential. Cloud gaming, in which any game can be played on any device without the consumer having to own the physical hardware required to process the game, presents a significant opportunity to expand the market for premium games beyond the current console and PC audience. Major gaming brands are looking for new ways to deliver gaming and are unveiling cloud gaming platforms. Faster internet along with 5G makes the technology feasible in more markets .

Cross-platform gaming becoming mainstream

With gaming publishers competing to expand their markets and potential audience, they are looking to create games that are played on a wide range of devices/platforms. Going forward, gamers are likely to focus more on which games they play and with whom and less on which devices they own. Players who enjoy playing with friends do not need to own the same gaming platform, be it PlayStation, Xbox, or PC, and so on.

Significant use of data analytics

Sports organisations must actively engage their different fan segments both inside and outside the game venue — they need to be agile, flexible and able to evolve their offerings. Data analytics offers the ability to give fans an exceptional experience, by getting the right content to individuals at the right time. Allowing real-time interaction and engagement, by creating relevant, consistent and personalized content helps establish a deeper connection with fans. During the game, viewers have the possibility to access instant replays, alternate views and closeup videos, vote for their favorite player, bookmark and comment. Data analytics is also used to improve public attendance and event monitoring, fine tune players, team playbooks, game plans and even to kickstart sales and promotions. Performance analytics is being used to identify weaknesses, track improvements and observe trends. Analytics is also helping professional sports teams prevent sports injuries by analyzing the data collected from wearable devices.

Moving forward what will be the gaming scene?

Here is a highlight on how the gaming scene of India will be according to the gaming experts:

Skill-based games to expand more

Nazara Technologies CEO Manish Agarwal says: “Skill Based Games played for real money + Competitive multiplayer + eSports will drive the overall gaming market going forward”. Moving on the same track All India Gaming Federation CEO Roland Landers said “ Online Real Money Skill Gaming (RMG) Industry is now poised to grow exponentially owing to the rise in digitally rich consumers and financial inclusion. The Industry needs rational taxation, both on methodologies and rates based on International best practices and endorsement of the AIGF self-regulation charter that governs stakeholders, so that businesses continue to expand and attract investments.” Junglee Games CEO Ankush Gera expects “The skill gaming industry, with close to a billion dollars in annual revenues on the backbone of Rummy and Fantasy Sports, is one of the fastest growing digital verticals in India, already seeing close to 100percent year-on-year growth. This industry will continue to beat all projections. Gaming is the opportunity for a billion screens in India and it has fully arrived.”

Digital interaction supported gameplay preference will increase

Amid the global lockdown due to coronavirus where people are practicing social distancing digital interaction is the only option left people are enjoying gaming as it also open avenues to interact with dear ones. Therefore Khel Group co-founder Nitesh Damani says, “The idea of ‘Lone Gamer’ is not true any more. A lot of gaming and a lot of interaction is no longer physical; it’s all digital and at a distance. I think there’s been this rediscovery of the joy of playing with people around the table.”

Poker possibilities in India

According to Spartan Poker founder and managing director Amin Rozani , “There has been an upward trend in the growth of poker in India, especially over the past 2 years and we believe this will continue going ahead with great value offerings and top-notch customer service driving the way.”

Adda52 CEO Naveen Goyal “Poker is a mind sport, played responsibly to learn life skills, probability and business. Gaming can take one to success in multiple facets of life.”

Multiplayer games and casual games to follow the trend

India Game Developer Conference Convenor Rajesh Rao says , “While real money gaming continues to grow rapidly, success of PUBG shows people’s propensity to spend on multiplayer games and casual should follow. With India’s per capita income being around 1/5th of China, it wouldn’t be unreasonable to forecast a games market 1/6th of China, after adjusting for lower disposable income in India… This would mean a India market in the US$4-US$7 billion range.”

10x increase in pay to play will open new avenues

Octro CEO Saurabh Aggarwal says, “India Gaming just levelled up. The 10x increase in the number of people willing to pay in games is an indication of the great things to come.”

Gaming next level

Pocket Aces co-founder Anirudh Pandita says “Globally, gaming has become a centerpiece of the consumer entertainment experience today with US gaming industry revenues now outpacing Hollywood box office receipts and approaching TV revenues. In India, increasing smartphone penetration along with cheap data is fuelling growth in gaming. Big beneficiaries have been hardcore games and gaming platforms. We are at the beginning of a secular trend that will continue for a while and will result in the formation of a gaming, game streaming, and esports ecosystem.

PokerStars India India CEO Ankur Dewani also believes that “India is perhaps one of the most exciting countries to be in for the next few decades, and we are all extremely proud and happy to be part this journey in our country’s growth phase, and in that hopefully bringing about a positive change for our industry along the way!”

As the online gaming sector gained a steady pace in the digital age India’s plan in becoming the hub of online gaming continues.

To find the latest and most popular casino games visit Casino Rank.