BENGALURU: Prime Focus Limited (PFL) has posted disappointing results for the quarter (Q5-2014). The company also posted results for the extended 15 month period ended 30 June, 2014 (15M-2014). The company reported a PAT of Rs 24.26 crore or about 2.3 per cent of Total Income from operations (TIO) for 15M-2014 as compared to the extrapolated loss of Rs 20.31 crore against TOI of Rs 762.16 crore during the equivalent period of 15 months ended 30 June, 2013(15M-2013). The reported TIO for 15M-2014 is Rs 1032.72 crore, an increase of 35.5 per cent as compared 15M-2013.

Earlier, for the four quarter period ended 31 March, 2014 (FY-2014), the company had posted a PAT of Rs 33.04 crore (4 per cent of TIO) against a TIO of Rs 834.89 crore. For FY-2013, the company had reported loss of Rs 16.85 crore. DuringFY-2014, PFL had reported a net forex gain of Rs 29.21 crore and for FY-2013 an exchange gain of Rs 6.75 crore. During 15M-2014 the company has reported forex gain of Rs 38.07 crore, 5.6 times the Rs 6.75 crore in 15M-2013.

Note: (1) 100,00,000 = 100 Lakhs = 10 million = 1 crore

All figures in this report are consolidated unless stated otherwise.

During the quarter ended 30 June, 2014 (Q5-2014), PFL reported Total Income from Operations of Rs 199.30 crore which was 15.8 per cent less than the Rs 236.60 crore in Q4-2014 and 5.7 per cent more than the Rs 188.47 crore in Q1-2014 (quarter ended 30 June, 2013). The company reported a loss of Rs 8.78 crore in Q5-2015, a loss of Rs 7.16 crore in Q4-2014 and a profit of Rs 21.34 crore in Q1-2014.

Let us look at the other numbers reported by the company for Q5-2015 and 15M-2014

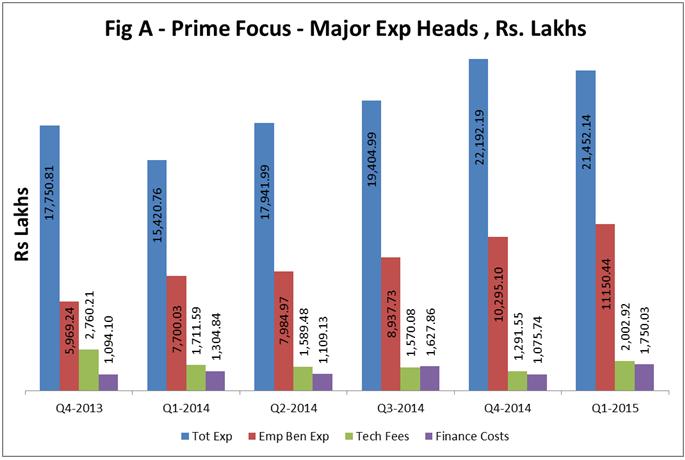

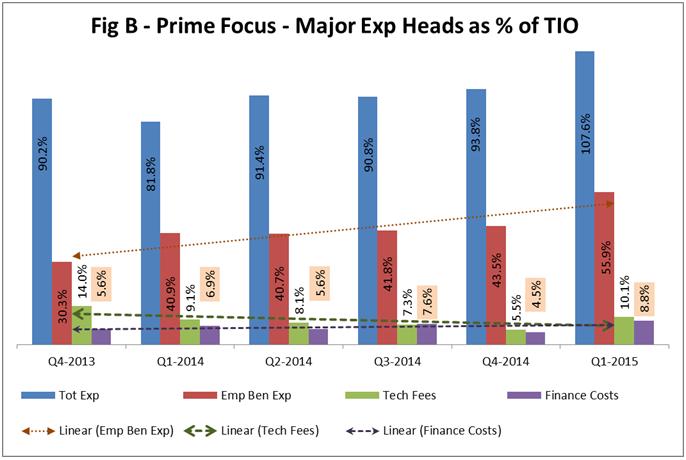

The company’s Total expenditure (Tot Exp) in 15M-2014 at Rs 969.16 crore (93.8 per cent of TIO) has been calculated at 41.1 per cent more than the Rs 686.76 crore (90.1 per cent of TIO) for 15M-2013.

A major component of the company’s expense is Employee Benefit Expense (EBE). PFL’s EBE for 15M-2014 at Rs 459.78 crore (44.5 per cent of TIO) was 49.1 per cent more than the Rs 308.40 crore (40.5 per cent of TIO) for 15M-2013.

Technicians fees for 15M-2014 at Rs.81.67 crore (7.9 per cent of TIO) was 6.7 per cent more than the Rs 76.56 crore (10 per cent of TIO) in 15M-2013. PFL finance costs went up 64.2 per cent to Rs 68.68 crore (6.1 per cent of TIO) in 15M-2014 versus the Rs41.83 crore (5.5 per cent of TIO) in 15M-2013.

Please refer to Fig A and Fig B below for quarterly expenses.

Prime Focus Technology (PFT), a subsidiary of the company, raised Rs 46.14 crore through private placement of optionally convertible debentures (OCD) in three tranches – Rs.19.92 crore on March 15, 2014, Rs.21.15 crore on 15 April, 2014 and Rs 5.07 crore in 16 April, 2014. The company says that the funds raised would be used to fund expansion of its cloud technology ‘Clear’ in the global markets as well as for retiring debt. After 2 years, the investors would have the option of converting upto 25 per cent of the total principal amount into equity of PFT.

Effective 30 June, 2014, the company sold its backend business which includes (a) business of providing services of conversion of 2D audio visual/moving images to stereo 3D audio visual/moving images provided the company to Prime Focus World N. V. (PFW), a company incorporated under the laws of Netherlands (Conversion business). (b) The business of providing the services of computer generated film visual effects by the company to PFW (VFX business) to Prime Focus World Pvt. Ltd., a company incorporated in India and an indirect controlled subsidiary of the company on a going concern basis for a total consideration of Rs 229.7 crore and recognized gain on standalone of Rs 197.2 crore.

The company has made provision in standalone result for doubtful loans and advances recoverable from its subsidiary Prime Focus London Plc for Rs 135.3 crore and for diminution in its investment value of Rs 51.4 crore considering the subsidiary’s sustained losses.

Exceptional items have pared the consolidated results as follows: Rs 17.41 crore for the period ended 30 June, 2014; Rs 107.66 crore for the period ended 30 June, 2013.

In July 2014, PFL and Reliance Group entity, Reliance MediaWorks (RMW) announced combination of their global film & media services business, by way of which PFL received Equity infusion of Rs 240 crore at Rs52 per share into Prime Focus Ltd. by Reliance MediaWorks and the Promoters of Prime Focus, in equal proportion. The deal proceeds are to be used to fund the recent merger of Double Negative, the Academy Award winning visual effects provider, with Prime Focus World (PFW). The Prime Focus promoters’ fully diluted stake to be 33.5 per cent and Reliance MediaWorks’ fully diluted stake to be 30.2 per cent. Prime Focus promoters and Reliance MediaWorks are to launch an open offer to acquire 26 per cent of the fully diluted equity capital in compliance with SEBI guidelines. The combined revenues of both the companies are estimated to be in excess of Rs 1,800 crore (including the announced merger of Double Negative with Prime Focus World), and robust order pipeline of about Rs 2,000 crore.

In August this year, PFT announced their plans to expand operations in Bengaluru. With over 500 employees at its existing Bengaluru facility, PFT is now set to open a new facility at RMZ Ecospace that can seat an additional 500 people. The new centre will cater to major international client engagements, including MNET, Warner Bros., IFC and A&E TV Network.

Click here for the financial release

Also read:

Reliance MediaWorks and Prime Focus merge film business in a game changing collaboration

Prime Focus World and Double Negative merge Hollywood VFX business

Prime Focus to open new 500 seat facility in Bengaluru SEZ

FX Networks gets into a strategic deal with Prime Focus Technologies

Prime Focus Technologies will provide play out monitoring service for BARC