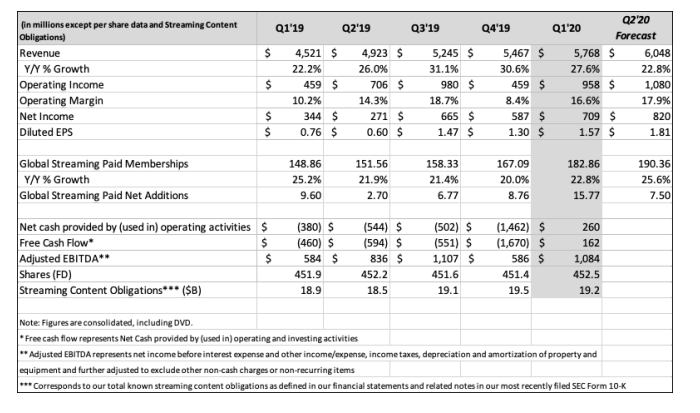

Netflix has witnessed a massive increase in its subscriber growth with 15.77 million paid subscribers in the first quarter (Q1) of 2020. Contributing to this 23 per cent jump in subscriber growth in comparison to that of last year, is the worldwide lockdown imposed due to the Coronavirus pandemic. It was earlier expected by the platform that the subscriber growth would be 7 million.

The streaming giant has also seen a 110 per cent increase in time spent with a 50.71 per cent increase in engagement rate and 54.80 per cent increase in active user count (according to Bobble AI report).

However, Netflix is practical enough to expect a decline in viewing and growth in the near future when the lockdown will be lifted with progress against COVID-19.

“Like other home entertainment services, we’re seeing temporarily higher viewing and increased membership growth… We expect viewing to decline and membership growth to decelerate as home confinement ends, which we hope is soon,” it mentioned in the letter to its shareholders.

Having added so many new subscribers, technically Netflix was supposed to exceed its revenue and EPS expectations as well. But that wasn’t the case. According to the company, the impact of the strengthening U.S. dollar versus other foreign currencies, and a $218 million charge for pausing productions, along with a hardship fund commitment, put a dent in the service’s bottom line. “In our case, this is offset by a sharply stronger US dollar, depressing our international revenue, resulting in revenue-as-forecast,” the letter informed.

It further added, “Our internal forecast and guidance is for 7.5 million global paid net additions in Q2. Given the uncertainty on home confinement timing, this is mostly guesswork. The actual Q2 numbers could end up well below or well above that, depending on many factors including when people can go back to their social lives in various countries and how much people take a break from television after the lockdown.”

Some of the lockdown growth will turn out to be pull-forward from the multi-year organic growth trend, resulting in slower growth after the lockdown is lifted country-by-country. Intuitively, the person who didn’t join Netflix during the entire confinement is not likely to join soon after the confinement.

Netflix co-founder and CEO Reed Hastings later said in an earnings call that the long-term implication is still tough to predict as the world is grappling with uncertainty. But he also added that they are certain about the increase in “internet entertainment’s” in people’s lives, which will be gradually more important in the next five years.

“The things we are certain of is the Internet is growing. It’s a bigger part of people’s lives, thankfully. And people want entertainment. They want to be able to escape and connect, whether times are difficult or joyous. That’s pulling up. We’ve had an increase in subscriber growth in March. It’s essentially a pull forward of the rest of the year. So our guess is that subs will be light in Q3 and Q4 relative to prior years because of that. But we don’t use the words guess and guesswork lightly. We use them because it’s a bunch of us feeling the wind, and it’s hard to say. But again, will Internet entertainment be more and more important over the next five years? Nothing has changed in that,” said Hastings in the later earnings call.

Along with subscriber numbers, Netflix also published its Q1 revenue which was $5.77 billion, while net income stood at $709 million with EPS of $1.57. The company’s stock was still down nearly 3 per cent in early trading on 22 April.

However, with productions around the world being temporarily paused, the streaming powerhouse is going to have to keep up with lack of fresh content in the near future, when it will not have any new shows to roll out. Owing to this situation, it may not have any new shows in the later half of the year.

In response to this crisis, naturally there will be less cash spending this year as some content projects are pushed out. This will shift out some cash spending on content to future years. Netflix hopes this dynamic may result in more lumpiness in its path to sustained free cash flow profitability.

Commenting on the impact of production stoppage, Netflix chief content officer Ted Sarandos noted, “The one thing that’s not widely understood is that we work really far out, relative to the industry, because we launch our shows with all episodes at once, and we’re working far out all over the world. So our 2020 slate of series and films are largely shot, and we are in post production remotely in locations all over the world. So, and we’re actually pretty deep into our 2021 slate. So we’re not anticipating big moving things around. And to give you some examples, The Crown, in its fourth season; our big fourth quarter animated release, Over the Moon. These are shot productions in our in the finishing stages right now to release later this year as planned. So we don’t anticipate moving the schedule around much and certainly not in 2020.”

For Q2, Netflix is looking forward to releasing all its originally planned shows and films with some language dubbing impacts on a few titles. They’re also finding ways to bolster its programming this year – including the recent acquisition of Paramount’s and Media Rights Capital’s The Lovebirds, a comedy starring Issa Rae and Kumail Nanjiani, for Q2 and Legendary Pictures’ Enola Holmes starring Millie Bobby Brown, Helena Bonham Carter, Henry Cavill, and Sam Claflin, for Q3 2020. So, while it’s certainly impacted by the global production pause, it expects to continue to be able to provide a wide variety of new titles and quality throughout 2020 and 2021.

Still, the streaming giant remains equally uncertain about when production will resume. But it has emphasised that it will look for the ability to test for the virus, work with production partners and local governments. It will also try to learn from its current experiences in Iceland and South Korea where productions are still on and will apply the same to other geographies, as Sarandos shared in the earnings call.